The Canadian Vanguard Stock Market Report – Wednesday, May 7, 2025

Futures are up as President Trump scheduled a Major Trade Deal announcement for 10:00am Thursday

.

The Toronto Market

The Toronto market, down in the last two consecutive sessions, was up today, bringing an end to that short trend. The TSX composite index advanced 186.46 points or 0.75%, to close the session at 25,161.18. The total volume of shares traded today was significantly higher compared to the total volume of shares traded yesterday.

The Market Breadth: Seven of the ten major sectors gained in the market session. Technology, up 1.61%, was the top sector and Industrials, up 1.38%, was next. The two sectors were the laggards yesterday. Durable Consumer Goods and Services was up 1.145; Discretionary Consumer Goods and Services were up 0.88%; Energy gained 0.79%; Utilities gained 0.75%, and Financials gained 0.67%. Basic Materials was down -0.43%, and Telecommunications Services, down -0.71%, was the laggard today.

Industry Groups: The top five industry groups in the TSX today were: Beverages – Non-Alcoholic, up 5.37%; Leisure Products, up 5.32%; Office Equipment, up 3.74%; Retail – Specialty, up 3.20%; and Personal Products, up 2.92%.

Today’s Statistics

Today, the issues that gained (Advancers) outnumbered those that declined (Decliners). There were roughly two Advancers for every Decliner, or a more exact ratio of 2.32-to-1.0. In real numbers, there were 1,326 Advancers to 572 Decliners while 127 stocks remained Unchanged.

Today, there were 60 new 52-Week Highs and 11 new 52-Week Lows. There were 41 new 52-Week Highs and 10 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 403,749,767, or about 32%, or one third, more than the volume of 304,302,579 shares traded yesterday.

Market Roundup Report

Volume of total shares traded at the Toronto market today was up, one-third more, than the total volume traded yesterday. The real significance today is the size of the difference, which was thirty-two percent, and that this occurred at a session at which the index gained. The gain today by the index was 0.70% – a decent gain. That is positive and implies that the institutions, the big investors, are returning to the market. The TSX composite has, to a good extent, weathered Trump’s tariff disruptions relatively better than the US market indexes. Some tariff disruptions will likely continue throughout the Trump administration’s term, however, the frequency of the disruptions is reducing.

It is time for investors to start looking at turning the tariff disruptions into opportunities. The first step in achieving this is to manage exposure to the market better. Cash is King, but that does not mean to stay one hundred per cent in cash. Investors should combine fractional (40 to 60%) trades with, not letting one’s guard down completely. It should always be assumed that the US president could come up with more market disrupting tariffs at any time during his administration or at least until the mid-term elections.

.

The US Markets

All three indexes gained in essentially positive markets today. The Dow Jones Average index advanced 284.97 points or 0.70% to close at 41,113.97. The S&P 500 index was up 24.37 points or 0.43% to close at 5,631.28. The Nasdaq Composite gained 48.50 points or 0.27%, to close at 17,738.16. In small caps, Russell 2000 was up 6.47 points or 0.33% to close at 1989.66.

The Market Breadth: Eight of the major sectors gained today. Discretionary Consumer Goods & Services, up 1.03%, was the top sector today. Healthcare was up 0.70%; Industrials was up 0.66%; Utilities was up 0.31%; Financials was up 0.27%; and Durable Consumer Goods & Services gained 0.20%. Energy and Technology gained 0.16% each. Basic Materials and Telecommunications Services were the laggards, declining -0.62% and -0.72% respectively.

Industry Groups: The top five industry groups at the US markets today were: Marine Port Services, up 9.43%; Pharmaceuticals – Generic & Specialty, up 6.20%; Broadcasting, up 4.41%; Airport Services, up 4.23%; and Semiconductors, up 2.40%

Today’s Market Statistics

At the NYSE, the issues that gained (Advancers) outnumbered the issues that declined (Decliners). There were three Advancers for every two Decliners – decisive enough, or an exact ratio of 1.56-to-1.0. In actual numbers, there were 2,465 Advancers to 1,578 Decliners with 290 Unchanged.

Today, there were 83 new 52-Week Highs and 59 new 52-Week Lows. There were 95 new 52-Week Highs and 59 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 5,058,622,076, or 4.8%, almost one twentieth, more than the total volume of 4,827,936,426 shares traded yesterday.

On the NASDAQ, the Advancers totally outnumbered the Decliners. There were roughly six Advancers for every five Decliners, or an exact ratio of 1.23-to-1.0. In actual numbers, there were 2,433 Advancers to 1,974 Decliners with 271 Unchanged.

Today, there were 77 new 52-Week Highs and 126 new 52-Week Lows. There were 55 new 52-Week Highs and 110 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 8,322,543,441, or 14%, almost three in twenty, more than the total volume of 7,303,804,849 shares traded yesterday.

Market Roundup Report: President Trump has talked about a “Major Trade” deal announcement on Thursday at 10:00am. Speculation is that the trade deal will be with England. Nvidia shares rose on a report that the Trump administration plans to rescind a set of chip trade restrictions called the “AI diffusion” rule. Nvidia shares rose earlier today as the Trump administration prepared to rescind or review what’s known as the “AI diffusion rule.” Reviewing or rescinding this will effectively stop the set of artificial intelligence chip controls that had been previously scheduled to take effect from May 15, from taking effect. We will keep an eye on NVDA and AMD stocks tomorrow and report on them later for our readers.

.

Stock in the News /Stock To Watch

The Toronto Market

The Technology sector was the top sector today. Celestica Inc. (TSX:CLS) and Shopify Inc. both gained today. Shopify gained 1.59% or $2.05 to close at $131.29 with 2.7M shares traded today. A problem though, is that both Celestica’s and Shopify’s charts need repairs. Some care is, as such, required in trading the stocks. Celestica Inc. manufactures servers and support infrastructure for data centers. Trading Celestica requires keeping abreast of NVIDIA news and who is supplying the big technology companies’ data center equipment.

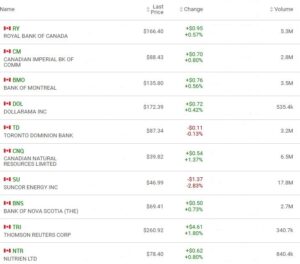

If you wish to avoid technology stocks altogether, then some stocks to consider are Bombardier (TSX:BBD.B) and Nutrient Ltd (TSX:NTR).

The US Markets

Nvidia Corp (NVDA) was up 3.10% or $3.52 to close at $117.06 with 207.8M shares traded today. Nvidia appears to be making a comeback. it is worth keeping an eye on. Netflix Inc. (NFLX) is also a stock worth keeping an eye. The stock is definitely extended but seems able to defy gravity in that sense.

.

Regular Market Day Features

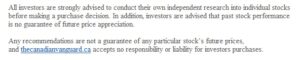

The Canadian Vanguard Beginner’s Watchlist

The Financials sector, dominated by the Canadian Big Six banks, was up 0.27% today. The sector is for now, simply marking time until tariff disruptions are over or some other trigger comes along to kick things forward.

The Blended Growth Stock Watchlist

There is likely to be a short-term rotation out of Gold stocks for now, or at least unless more tariff disruptions come along. This actually should be good for investors, as some of the gold miner stocks are currently either extended or close to being extended.

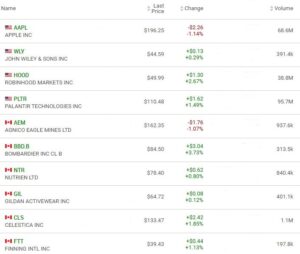

EV Manufacturers and Resource Stocks

Tesla EV sales continue to decline in China. The “new energy” stocks are gaining while EV manufacturers’ stocks are, for now, going nowhere.

NOTICE TO READERS