The Canadian Vanguard Stock Market Report – Weekend May 16 – 18, 2025 Edition

Downgrade of US credit rating could complicate market outlook in the near term

. Check in for regular updates throughout the weekend

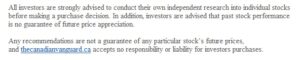

The Toronto Market, Friday, May 16

The TSX composite index gained 74.45 points or 0.29%, to close the session at 25,971.93. The TSX is truly on a roll. The index has been for up eight consecutive sessions. The total volume of shares traded was slightly higher today compared to yesterday.

The Market Breadth: Nine of the ten major sectors gained today. Retail stocks led with Discretionary Consumer Goods & Services sector gaining 1.11%; Healthcare gained 0.92%; Durable Consumer Goods & Services gained 0.87%; Industrials gained 0.71%; Technology was up 0.50%; Financials and Telecommunications Services sectors gained 0.39% each; and Utilities was up 0.23%. Basic Materials down, -0.40%, was the only sector that declined in the market on Friday.

Industry Groups: The top five industry groups in the TSX today were: Computer Hardware, up 8.36%; Media Diversified, up 4.98%; Retail -Drugs, up 3.39%; Retail – Department Stores, up 3.11%; and Highways & Railtracks, up 2.28%.

Today’s Statistics: Today, the issues that gained (Advancers) outnumbered those that declined (Decliners). There were roughly three Advancers for every Decliner, or a more exact ratio of 2.80-to-1.0. In real numbers, there were 1,371 Advancers to 492 Decliners while 152 stocks remained Unchanged.

Today, there were 142 new 52-Week Highs and 12 new 52-Week Lows. There were 110 new 52-Week Highs and 15 new 52-Week Lows on Thursday.

The total volume of shares traded at the TSX today was 395,258,352, or about the same as the volume of 392,455,431 shares traded on Thursday.

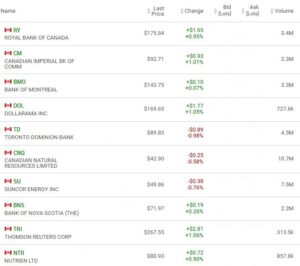

The US Markets, Friday, May 16

The Dow Jones Average index was up 331.99 points or 0.78% to close at 42,654.74. The S&P 500 index gained 41.45 points or 0.70% to close at 5,958.38. The Nasdaq Composite was up 98.78 points or 0.52%, to close at 19,211.10. In small caps, Russell 2000 was up 18.56 points, or 0.89%, to close at 2113.25.

![]()

The Market Breadth: The market was buoyant on Friday, nine of the major sectors gained in the market session. Healthcare was up 1.68%; Utilities was up 1.24%; Durable Consumer Goods & Services gained 1.11%; Industrials gained 1.10%; Telecommunications services was up 0.97%; Discretionary Consumer Goods & Services, was up 0.83%; Financials was up 0.47%; and Technology was up 0.28%. Energy, down -0.17%, was the bottom performer on Friday.

Industry Groups: The top five industry groups in the TSX today were: Managed Healthcare, up 5.03%; Rails & Roads – Passengers, up 3.91%; Marin Port Services, up 2.20%; Chemicals – Diversified, up 2.16%; and Fishing & Farming, up 2.09%.

Today’s Market Statistics

At the NYSE, the issues that gained (Advancers) outnumbered the issues that declined (Decliners). There were roughly five Advancers for every two Decliners, or an exact ratio of 2.72-to-1.0. In actual numbers, there were 3,001 Advancers to 1,104 Decliners with 304 Unchanged.

Today, there were 207 new 52-Week Highs and 34 new 52-Week Lows. There were 170 new 52-Week Highs and 46 new 52-Week Lows on Thursday.

The total volume of stocks traded today at the NYSE was 4,925,118,960, or 3% less than the total volume of 5,065,603,474 shares traded yesterday.

On the NASDAQ, the Advancers outnumbered the Decliners. There were roughly two Advancers for every Decliner, or an exact ratio of 1.81-to-1.0. In actual numbers, there were 2,900 Advancers to 1,602 Decliners with 160 Unchanged.

Today, there were 85 new 52-Week Highs and 11 new 52-Week Lows. There were 137 new 52-Week Highs and 128 new 52-Week Lows on Thursday.

The total volume of shares traded at the NASDAQ today was 10,974,290,607, or about the same as the total volume of 10,969,388,533 shares traded on Thursday.

Market Roundup Report

The downgrade of the US credit rating could create complications in the near term at markets as Wall Street reacts to the downgrade. Generally, the market rally is strong and a number of stocks are near buy points, however, Investors should be a bit cautious with big purchases while the Wall Street reaction plays out, as some volatility may return to the market in the near term.

Oil Price: US crude oil prices were down – $0.19 to $62.30 a barrel as of the time (11:30pm ET, Sunday) of this post update. U.S. crude oil futures rose 2.4% to $62.49 a barrel last week

10 –year Treasury Yield: The US Treasury 10-year yield rose to 4.44% Friday afternoon. The 10-year yield was at 4.513% as of the time (11:30pm ET, Sunday).

After-hours action: Futures are down Sunday evening. Dow Futures was down -316.00 points or -0.75% vs. fair value. S&P 500 futures was down -1.02%, and Nasdaq 100 futures was down -1.31% as of the time (12:15 am ET, Monday) of this post update.

.

Stock in the News /Stock To Watch

Applied Materials (AMAT) stock and Cava Group Inc. (CAVA) fell solidly on Friday. However, the small caps had a relatively good session on Friday. Some stocks to watch out for are: Loar Holdings (LOAR), Vita Coco (COCO) and Dutch Bros (BROS) and in the EV and New Energy industry groups, BYD Company (BYDDF) and NRG Energy Inc. (NRG).

.

Regular Market Day Features

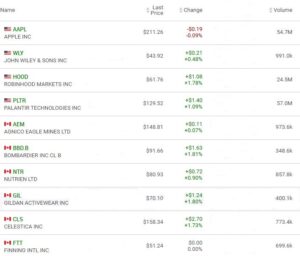

The Canadian Vanguard Beginner’s Watchlist

The Blended Growth Stock Watchlist

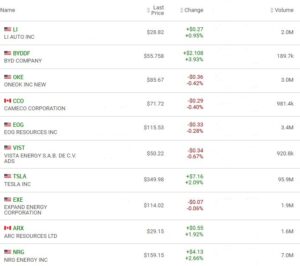

EV Manufacturers and Resource Stocks

BYD Company (BYDDF) in the Electric Vehicle industry group and NRG Energy Inc. (NRG) in the New Energy industry group are stocks strongly recommended to keep an eye on.

NOTICE TO READERS