The Canadian Vanguard Stock Market Report – Wednesday, May 21, 2025 Edition

Deficit Concerns Drive Bond Yields Up, Stocks Deep Down

.

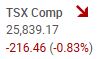

The Toronto Market

The TSX composite index fell -216.46 points or -0.83%, to close the session at 26,839.17. The TSX finally blinked today after nine consecutive sessions of gains. The decline today was well under 1%. Given the generally negative markets’ reaction to US Bond yields spiking today, a decline of 0.83% is nothing to be alarmed about, at least not unless it repeats for a couple of days or more. The total volume of shares traded was slightly more than the total volume traded yesterday.

Today’s Statistics: Today, the issues that declined (Decliners) outnumbered those that gained (Advancers). There were roughly seven Decliners for every two Advancers, or a more exact ratio of 3.46-to-1.0. In real numbers, there were 1,544 Decliners to 446 Advancers while 132 stocks remained Unchanged.

Today, there were 73 new 52-Week Highs and 34 new 52-Week Lows. There were 203 new 52-Week Highs and 19 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 408,918,457, or about 5% larger than the volume of 389,744,260 shares traded yesterday.

.

The US Markets

All three major indexes ended the session deeply negative today. The Dow Jones Average index cratered -816.80 points or -1.91% to close at 41,860.44. The S&P 500 index dove -95.85 points or -1.61% to close at 5,844.61. The Nasdaq Composite was down -270.07 points or -1.41%, to close at 18,872.64. In small caps, Russell 2000 dropped -59.02 points, or -2.80%, to close at 2046.56.

![]()

Today’s Market Statistics: At the NYSE, the issues that declined (Decliners) edged out the issues that gained (Advancers). There were roughly six Decliners for every Advancer, or an exact ratio of 5.82-to-1.0. In actual numbers, there were 3,580 Decliners to 615 Advancers with 239 Unchanged.

Today, there were 188 new 52-Week Highs and 104 new 52-Week Lows. There were 219 new 52-Week Highs and 33 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 5,336,764,734, or 19% larger than the total volume of 4,485,733,134 shares traded yesterday.

On the NASDAQ, the Decliners barely outnumbered the Advancers. There were roughly nine Decliners for every two Advancers, or an exact ratio of 4.42-to-1.0. In actual numbers, there were 3,662 Decliners to 827 Advancers with 216 Unchanged.

Today, there were 132 new 52-Week Highs and 120 new 52-Week Lows. There were 151 new 52-Week Highs and 54 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 11,444,578,320, or 22% larger than the total volume of 11,198,874,852 shares traded yesterday.

Market Roundup Report

Oil Price: US crude oil price dipped 0.2% to $62.56 a barrel today. US Oil price was back down at $61.55 a barrel as of the time (11:30pm ET, Wednesday) of this post update.

10 –year Treasury Yield: The US Treasury 10-year yield spiked to 4.61% in the afternoon today. The 10-year yield was at 4.585% as of the time (11:30pm ET, Wednesday) of this post update.

After-hours action: Futures are flat Wednesday evening. Dow Futures was down 1.00 point or 0.00% vs. fair value. S&P 500 futures was up 0.06%, and Nasdaq 100 futures was up 0.04% as of the time (11:30 pm ET, Wednesday) of this post update.

.

Stock In The News / Stock To Watch

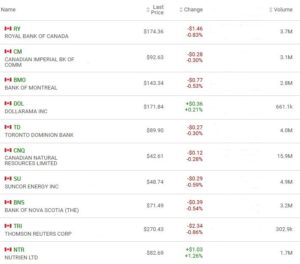

The Toronto Market

Aritzia Inc. (ATZ) was in consolidation for the past five sessions but broke the consolidation and went slightly south today under today’s market pressure. It is, however, a stock to keep an eye on. Another stock to keep an eye on, if today’s down draft persists in the short term, is Thomson Reuters (TRI). Some gold miner stocks managed to defy today’s carnage and ended the day gaining. Two such stocks are Franco Nevada and Agnico Eagle Mines (AEM). AEM stock gained $2.27% or $3.56 to close at $160.31 with 1.1M shares traded.

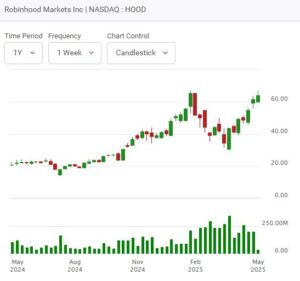

The US Markets

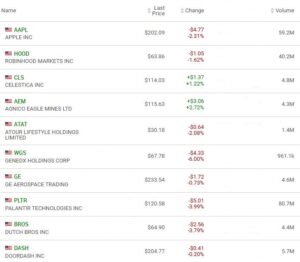

The market was driven today by the spike in Treasury yields. Weak auction of government debt triggered the spike in Treasury yields. The stock market reacted negatively, and stocks suffered major declines. There was also news of renewed curbs on exporting AI chips. The news will certainly affect Nvidia Corp (NVDA). Most technology stocks, such as Broadcom (AVGO), AMD and ARM Holdings (ARM), fell and generally did poorly today. Applovin Corporation (APP) fell and Palantir (PLTR) fell 3% and fell below its current buy point. Robinhood Markets (HOOD) is another stock we should keep within our view for now. The stock declined today, but that is a “good decline” as nothing man-made keeps going up forever, so some correction should be seen as positive. HOOD stock was down -1.62% or -$1.05, closing at $63.86 with 40.2M shares traded.

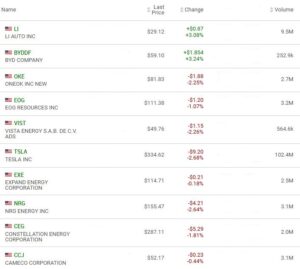

EV manufacturers’ stocks had a good showing today. Li Autos (LI) gained. BYD Company (BYDDF) is currently the world’s largest EV vehicle manufacturer. Xpeng Inc. (XPEV) is introducing a major competitor to one of Tesla’s main lines. XPEV stock gained 13% or $2.56 to end the market session today at $22.25 with 28.7M shares traded.

.

Regular Market Day Features

The Blended Growth Stock Watchlist

The Blended Growth Stock Watchlist

EV Manufacturers and Resource Stocks

NOTICE TO READERS