The Canadian Vanguard Stock Market Report – Thursday April 17, 2025

The Markets Rotate To Gold and Energy as Tariff Driven Uncertainties Persist

.

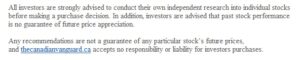

The Toronto Market

The TSX composite index was up 86.02 points or 0.36%, to close the session at 24,192.81. The TSX index has gained at each of the last four consecutive market sessions.

The Market Breadth: Seven of the major sectors ended the session with gains on Thursday. Telecommunications Services, up 1.82%, was the top sector. Energy gained 1.78%; Healthcare was up 1.45%; and Utilities, up 1.20% rounded up the top four sectors today. Durable Consumer Goods and Services was up 0.65%; and Financials was up 0.40%. Discretionary Consumer Goods & Services, down -0.11%, Technology, down -0.46%, and Basic Materials, down -1.27%, were the laggards at the market session today.

Industry Groups: The top five industry groups in the TSX today were: Publishing, up 25.60%; Construction Materials, up 6.89%; Electrical Components & Equipment, up 3.79%; Pharmaceuticals – Diversified, up 3.07%; and Wireless Telecommunications Services, up 2.86%.

Today’s Statistics: On Thursday, the issues that gained (Advancers) outnumbered those that declined (Decliners). There were roughly three Advancers for every two Decliners or a more exact ratio of 1.48-to-1.0. In real numbers, there were 1,127 Advancers to 762 Decliners while 127 stocks remained Unchanged.

Today, there were 24 new 52-Week Highs and 15 new 52-Week Lows. There were 48 new 52-Week Highs and 15 new 52-Week Lows on Wednesday.

The total volume of shares traded at the TSX on Thursday was 392,321,036 or roughly 5% more compared to the volume of 371,785,141 shares traded on Wednesday.

.

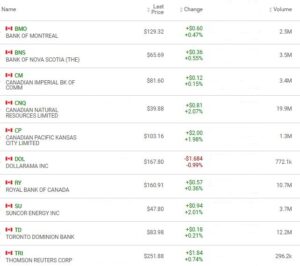

The US Markets

On Thursday, the Dow Jones Average index declined -527.16 points or -1.33% to close at 39,142.23. The S&P 500 index gained 7.00 points or 0.13% to close at 5,282.70. The Nasdaq Composite was down -20.71 points or -0.13%, to close at 16,286.45.

![]()

The Market Breadth: Eight of the eleven major sectors gained at the market session today with Energy, up 2.06%, the top sector for the second day running. The retail sectors did better at the market session compared to recent sessions. Durable Consumer Goods & Services was up 1.79%; Telecommunications Services was up 1.36%; Utilities gained 0.87%; and Financials was up 0.81%. Discretionary Consumer Goods & Services gained 0.77%; Basic Materials was up 0.39%. Healthcare, down -0.20%, and Technology, down -0.40%, were the bottom performers at today’s session.

Industry Groups: The top five industry groups at the US markets today were: Rails & Roads – Passengers, up a portfolio friendly 25.95% today, was up a hefty 18.71% yesterday; Oil & Gas Drilling, up 5.28%; Footwear, up 3.26%; Coal, up 3.24%; and Pharmaceuticals – Diversified, up 3.14%.

Today’s Market Statistics:

At the NYSE, the issues that gained (Advancers) outnumbered the issues that declined (Decliners). There were roughly three Advancers for every two Decliners or an exact ratio of 1.58-to-1.0. In actual numbers, there were 3,064 Advancers to 1,079 Decliners with 259 Unchanged.

Today, there were 35 new 52-Week Highs and 72 new 52-Week Lows. Yesterday, there were 80 new 52-Week Highs and 105 new 52-Week Lows.

On Thursday, the total volume of stocks traded at the NYSE was 4,766,025,780. This was 1% more compared to the total volume of 4,712,173,679 shares traded on Wednesday.

On the NASDAQ, the Advancers outnumbered the Decliners. There were roughly two Advancers for every Decliner or an exact ratio of 2.01-to-1.0. In actual numbers, there were 2,914 Advancers to 1,483 Decliners with 245 Unchanged.

There were 42 new 52-Week Highs and 138 new 52-Week Lows. There were 45 new 52-Week Highs and 182 new 52-Week Lows on Wednesday.

The total volume of shares traded at the NASDAQ today was 7,256,697,333. This is 12% less compared to the total volume of 8,208,534,118 shares traded on Wednesday.

Oil Price: U.S. crude oil price was up roughly 1% to $63.75 a barrel on Thursday.

10 –year Treasury Yield: US Treasury 10-year Treasury yield was down four basis points to 4.32% in late afternoon Thursday.

.

Regular Market Day Features

The Canadian Vanguard Beginner’s Watchlist

The Blended Growth Stock Watchlist

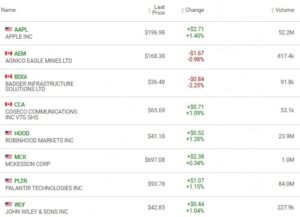

We reviewed and replaced some declining stocks within our watchlists. The market volatility and uncertainties of the past three weeks have resulted in a number of stocks declining significantly, resulting in the need to prune our non-industry specific watchlists. Gold stocks were down on Thursday but a good number of gold stocks were becoming extended so being down on Thursday should be seen for now as being positive.

EV Manufacturers and Resource Stocks

NOTICE TO READERS