The Canadian Vanguard Stock Market Report – Monday, April 21, 2025

The Dow Jones Index cratered today, and the other indexes were not far behind.

.

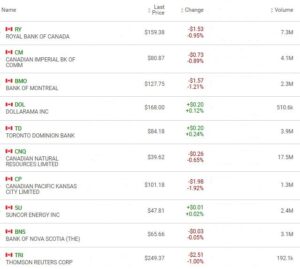

The Toronto Market

The TSX composite index declined -183.95 points or -0.76%, to close the session at 24,008.86. The TSX composite index gained in the last four consecutive market sessions, but today the tariff’s trauma caught up with the TSX. There was a slightly positive aspect to the decline today, if we must locate one, was that the volume of shares today was slightly less than the volume at the last market session.

The Market Breadth: Only four of the ten major sectors gained at the market session today. Telecommunications Services, up 0.82%, was the top sector, repeating Thursday’s lead performance; Durable Consumer Goods and Services was up 0.73%; Basic Materials gained 0.22%; and Discretionary Consumer Goods & Services, gained 0.16%. Utilities was down -0.54%; Energy declined -0.87%; Financials was down -0.87%; and Technology, down -2.02%, was the laggard sector.

Industry Groups: The top five industry groups in the TSX today were: Publishing, up 21.12% but was up 25.60% on Thursday; Marine Transportation, up 2.03%; Semiconductors, up 1.60%; Retail – Apparel & Accessories, up 1.48%; and Integrated Telecommunications Services, up 1.45%. Some of the members of the Publishing Companies Industry Group are: Everybody Loves Languages Corp (TSX: ELL), PostMedia Network Canada Corp (TSX: PNC.A), FP Newspaper Inc. (TSX: FP) and China Education Resources Inc. (TSX: CHN.H).

Today’s Statistics: Today, the issues that declined (Decliners) outnumbered those that gained (Advancers). There were three Decliners for every Advancer, or a more exact ratio of 3.00-to-1.0. In real numbers, there were 1,439 Decliners to 481 Advancers while 109 stocks remained Unchanged. The session was bearish.

Today, there were 65 new 52-Week Highs and 43 new 52-Week Lows. There were 24 new 52-Week Highs and 15 new 52-Week Lows on Thursday.

The total volume of shares traded at the TSX today was 390,802,415 or practically the same compared to the volume of 392,321,036 shares traded on Thursday.

.

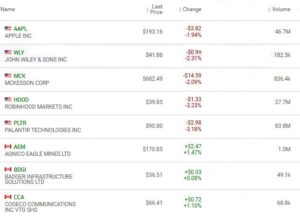

The US Markets

Today, all three indexes were down at least -2% each. The Dow Jones Average index cratered -971.82 points or -2.48% to close at 38,170.41. The S&P 500 index declined -124.50 points or -2.36% to close at 5,158.20. The Nasdaq Composite declined -415.55 points or -2.55%, to close at 15,870.90. It was a totally bearish session.

![]()

The Market Breadth: The market today was so lopsidedly bearish that all the major sectors declined. The retail sector led the sectors with Durable Consumer Goods & Services, down -0.95%, being the top performer. Basic Materials was down -1.11%; Financials was down -1.75%; Energy was down -2.18%; Utilities was down -2.21%; Telecommunications Services declined -2.31%; Technology, down -2.54%; and Discretionary Consumer Goods & Services, down -2.55% was the laggard sector today.

Industry Groups: The top five industry groups at the US markets today were: Tires & Rubber Products, up 1.85%; Mining & Metals – Specialty, up 0.42%; Apparel & Accessories, up 0.36%; Precious Metals & Minerals, up 0.35%; and Beverages – Distillers & Wineries, up 0.33%.

Today’s Market Statistics: At the NYSE, the issues that declined (Decliners) outnumbered the issues that gained (Advancers). There were roughly five Decliners for every Advancer, or an exact ratio of 4.76-to-1.0. In actual numbers, there were 3,457 Decliners to 726 Advancers with 231 Unchanged. It was a market session to be favoured by short sellers only. It was a terribly bearish session.

Today, there were 77 new 52-Week Highs and 180 new 52-Week Lows. On Thursday, there were 35 new 52-Week Highs and 72 new 52-Week Lows.

The total volume of stocks traded today at the NYSE was 4,282,841,070. This was 10% less compared to the total volume of 4,766,025,780 shares traded on Thursday.

On the NASDAQ, the Decliners outnumbered the Advancers. There were roughly five Decliners for every two Advancers, or an exact ratio of 2.65-to-1.0. In actual numbers, there were 3,222 Decliners to 1,216 Advancers with 213 Unchanged.

Today, there were 44 new 52-Week Highs and 202 new 52-Week Lows. There were 42 new 52-Week Highs and 138 new 52-Week Lows on Thursday.

The total volume of shares traded at the NASDAQ today was 6,865,392,452. This is 5.0% less compared to the total volume of 7,256,697,333 shares traded on Thursday.

Oil Price: US crude oil price was at $63.53 a barrel, up 0.71%, as of the time (12:30am EDT, Tuesday) of this post update.

10 –year Treasury Yield: US Treasury 10-year Treasury yield was up and was at 4.4% in late afternoon today. The 10-year yield was at 4.42%, as of the time (12:30am EDT, Tuesday) of this post update.

After-hours action: Futures were up Tuesday evening after a very bearish session on Monday. The Dow Futures was up 0.41% vs. fair value. S&P 500 futures was up 0.57%, and Nasdaq 100 futures was up 0.58% as of the time (12:30am EDT, Tuesday) of this post update.

Market Roundup Report: The indexes closed off lows today, but the lows were quite low, and so the indexes’ closings were equally quite low. All the major indexes suffered -2% or worse decline. When an index comprising a hundred or more stocks goes down -2% or worse, the session should be seen as very negative, and investors should read it as signaling a time for caution when planning trades. This is especially so, given that the Dow has continuously been trending south since early February.

The market rotated to Gold several sessions back. Energy was added later, but Gold is where the market is at, right now, and Growth is certainly on the back burner. Gold and Gold miner stocks are where to be now. However, a number of the gold stocks are either extended or close to being extended, so it is time to consider being in cash, especially for growth investors. The market will eventually return to normal and opportunities for good profit will become abundant again, but of course, only to those who have preserved capital.

.

Stock In The News / Stock To Watch

The Dow Jones first hit a high of 45,000 on November 28. It hit 45,054 on January 30, but has kept declining since then and looks set to again take out the one-year low of 38,000 within the next few sessions. The market has rotated out of technology stocks for now. Nvidia Corp (NVDA), was down -4.51% or -$4.58 to close at $96.91 with 288.5M shares traded.

Franco Nevada Corp (FNV), Agnico Eagle Mines Ltd (AEM) and AngloGold Ashanti PLC (AU) are three gold miner stocks that are worth keeping an eye on as the trade war rhetoric rages on.

.

Regular Market Day Features

The Canadian Vanguard Beginner’s Watchlist

The big banks were down on Monday both in Canada and in the US markets.

The Blended Growth Stock Watchlist

EV Manufacturers and Resource Stocks

No sector appears safe from the current market carnage. Energy stocks were leading last week but were down heavily on Monday.

NOTICE TO READERS