The Canadian Vanguard Stock Market Report – Tuesday, April 22, 2025

Lopsidedly bullish, the markets did an about-face, totally reversing yesterday’s bearish market outlook.

.

The Toronto Market

The TSX composite index jumped 297.12 points or 1.24%, to close the session at 24,305.98. The TSX composite index declined yesterday, but the index is back on track, gaining today and has, as such, been up now five out of the past six market sessions despite Mr. Trump’s tariff threats and the likelihood or possibility of a trade war.

The Market Breadth: Eight of the ten major sectors gained in the market session today. Technology, a frequent laggard during the past couple of weeks, was the top sector. The retail sectors continue to do well. Discretionary Consumer Goods and Services, up 2.02%, was the second best performer; Energy was up 1.87%; and Financials was up 1.85%. Utilities gained 0.95%; Durable Consumer Goods and Services was up 0.78%; and Industrials was up 0.50%. Telecommunications Services, declined and Basic Materials declined -0.77%, bringing up the rear.

Industry Groups: The top five industry groups in the TSX today were: Auto & Truck Manufacturers, up 7.86%; Construction Materials, up 6.03%; Computer Hardware, up 5.86%; Paper Products, up 5.07%; and Medical Equipment, Supplies & Distribution, up 4.72%.

Today’s Statistics: Today, the issues that gained (Advancers) outnumbered those that declined (Decliners). There were three Advancers for every Decliner, or a more exact ratio of 3.00-to-1.0. In real numbers, there were 1,505 Advancers to 417 Decliners while 144 stocks remained Unchanged. The session was bullish.

Today, there were 50 new 52-Week Highs and 21 new 52-Week Lows. There were 65 new 52-Week Highs and 43 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 380,357,304, or 3% less compared to the volume of 390,802,415 shares traded yesterday.

.

The US Markets

The Dow Jones Average index jumped 1,016.57 points or 2.66% to close at 39,186.98. The S&P 500 index advanced 129.56 points or 2.51% to close at 5,287.76. The Nasdaq Composite vaulted 429.52 points or 2.71%, to close at 16,300.42. The markets today simply reversed yesterday’s bearish performance.

![]()

The Market Breadth: The markets today were like a rising tide that lifts all boats. All ten major sectors gained today, and the retail sector led the sectors. Discretionary Consumer Goods & Services, up 3.00%, was the top performer, while Financials roared back with a 2.93% gain today. Utilities was up 2.72%; Technology gained 2.72%; Energy was up 2.25%; Industrials was up 2.13%; Basic Materials was up 1.87%; Discretionary Consumer Goods & Services was up 1.76%; and Telecommunications Services, up 1.51%, was the laggard sector today.

Industry Groups: The top five industry groups at the US markets today were: Marine Port Services, up 14.10%; Rails & Roads – Passengers, up 6.58%; Tires & Rubber Products, up 5.24%; Homebuilding, up 4.30%; and Aluminum, up 3.92%.

Today’s Market Statistics: At the NYSE, the issues that gained (Advancers) outnumbered the issues that declined (Decliners). There were roughly thirteen Advancers for every two Decliners, or an exact ratio of 6.40-to-1.0. In actual numbers, there were 3,554 Advancers to 555 Decliners with 247 Unchanged. The market was very bearish yesterday but reversed to lopsidedly bullish today.

Today, there were 50 new 52-Week Highs and 44 new 52-Week Lows. There were 77 new 52-Week Highs and 180 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 4,752,679,988, or 11% more compared to the total volume of 4,282,841,070 shares traded yesterday.

On the NASDAQ, the Advancers outnumbered the Decliners. There were roughly nine Advancers for every two Decliners or, an exact ratio of 4.60-to-1.0. In actual numbers, there were 3,630 Advancers to 794 Decliners with 230 Unchanged.

Today, there were 55 new 52-Week Highs and 84 new 52-Week Lows. There were 44 new 52-Week Highs and 202 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 7,311,776,597, or 6.5% more compared to the total volume of 6,865,392,452 shares traded yesterday.

After-hours action: Futures were up Tuesday evening. The Dow Futures was up 1.17% vs. fair value. S&P 500 futures was up 1.56%, and Nasdaq 100 futures was up 1.89% as of the time (12:30am EDT, Wednesday) of this post update.

Market Roundup Report: The markets today were like a rising tide that lifts all boats. The indexes reversed yesterday’s bearish market losses. The difference today was that the indexes gained, supported by an increased volume of shares traded. There was also a good market breadth – all the market sectors gained today. More recently the volume of stocks traded was up when the indexes declined, but when the indexes gained, such gains came accompanied by reduced volume of shares traded. Today was different, all the indexes gained, and the volume of shares traded was up ten per cent on the NYSE and five percent on the NASDAQ.

In addition, there was the good news about the possible de-escalation of the tariff tension with China. Also, news had it that President Trump is not going to demand the resignation of the Chairman of the Federal Reserve, a potentially major constitutionally controversial move. We shall keep an eye on the market, and likely there will be reduced volatility going forward. Of course, we do not trade based on hope. We trade based on real market data and proper analysis.

.

Regular Market Day Features

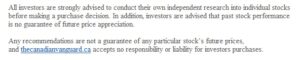

The Canadian Vanguard Beginner’s Watchlist

Dollarama (DOL) was up $22 or 13% since April 8th. It is time to take a look at the banks. RY looks worth keeping an eye on in the near term. Income investors are reminded that the higher stock price, the lower the dividend yield. It is, of course, always smarter to buy low.

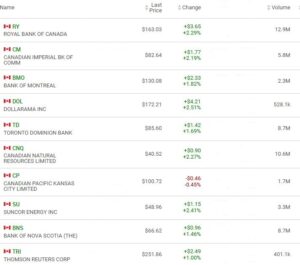

The Blended Growth Stock Watchlist

Gold price was down today. A number of the gold miner stocks were also down today, which was good because some of them were trending towards being extended. If your stock gains twenty percent or more in two weeks, it is a good idea to take some profit. It is a good idea to always take partial or total profit at 20% gain – Nothing goes up forever! If there is a de-escalation of the tariff tension, then the markets may become less volatile, and the gold price may stabilize. If your gold miner stocks are extended, you may look at energy stocks. Investors may likely rotate back to Technology.

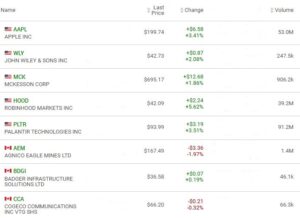

EV Manufacturers and Resource Stocks

It may be time to look at “new energy ” – environmentally friendly energy stocks. CEG, VIST and EXE stocks are worth keeping an eye on.

NOTICE TO READERS