The Canadian Vanguard Stock Market Report – Weekend April 25-27, 2025 Edition

Technology Stocks and The Magnificent Seven Are On The Upswing

.

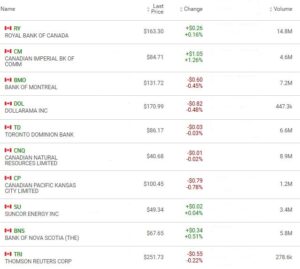

The Toronto Market (Friday, April 25)

The TSX composite index was down slightly at -17.02 points or -0.07%, to close the session at 24,710.51. The TSX composite index took a break on Friday, and how long will this break last? We shall likely find out within the next couple of sessions or early in the next week.

The Market Breadth

Six of the ten major sectors gained in Friday’s market session. Technology, up 1.06%, was the top performer. Utilities was up 0.43%; Durable Consumer Goods and Services gained 0.29%; Financials, still on the way to recovery from President Trump’s tariffs, gained 0.24%; and Energy gained a paltry 0.04%.Discretionary Consumer Goods and Services declined -0.02%; Basic Materials declined -0.65%; Telecommunications Services was down -0.71%, and Industrials was down -0.86%.

For The Week: Healthcare sector, up 9.73%, was the top gainer for the week. Technology, up 9.49%, also had a good week and looks likely to continue in the near term as the sector has some momentum that should carry it forward. The market will, of course, always do what it wishes to do. Discretionary Consumer Goods & Services was up 3.45%; Financials was up 3.16%; Energy was up 1.75%; Durable Consumer Goods & Services was up 1.07% and Basic Materials gained 0.47%. Industrials and Telecommunications Services were the laggards declining -0.14% and -0.99% respectively.

Industry Groups: The top five industry groups in the TSX today were: Auto & Truck Manufacturers, up 4.62%; Publishing, up 3.35%; Paper Products, up 2.92%; Communications Equipment, up 1.95%; and IT Services & Consulting, up 1.79%.

Today’s Statistics: Today, the issues that gained (Advancers) outnumbered those that declined (Decliners). There were four Advancers for every three Decliners, or a more exact ratio of 1.34-to-1.0. In real numbers, there were 1,062 Advancers to 792 Decliners while 171 stocks remained Unchanged.

Today, there were 27 new 52-Week Highs and 4 new 52-Week Lows. There were 27 new 52-Week Highs and 3 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 327,168,494, or 5% less compared to the volume of 344,607,911 shares traded yesterday.

.

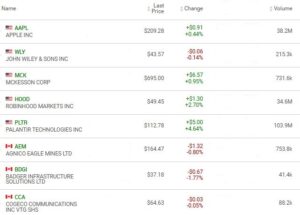

The US Markets (Friday, April 25)

The Dow Jones Average index was up a mere 20.10 points or 0.05% to close at 40,113.50. The S&P 500 index gained 40.44 points or 0.74% to close at 5,525.21. The Nasdaq Composite advanced 216.90 points or 1.26%, to close at 17,382.94. Nasdaq remains on the upswing, while the Dow index was somewhat a little hesitant on Friday.

![]()

The Market Breadth

Only four of the major sectors gained on Friday. Retail and Technology were the session’s top-performing sectors. Discretionary Consumer Goods & Services was up 1.45%, and Technology was up 1.41%. Energy was up 0.13%, and Healthcare was up 0.08%. Financials was down -0.26%; Durable Consumer Goods & Services declined -0.42%; Basic Materials gained 2.21%; and Telecommunications Services, down -3.71%, was the day’s laggard.

For The Week: Technology, up 14.77%, had its best week to date this year. Discretionary Consumer Goods & Services gained 6.32%; Industrials gained 3.49%; Technology was up 5.36%; Financials was up 3.71%; Industrials gained 3.49%; and Basic Materials gained 2.93%. Durable Consumer Goods & Services declined -0.56% and Telecommunications Services was down -2.21% for the week. It was a good week for stocks, especially after weeks of tariff-driven extreme volatility.

Industry Groups: The top five industry groups at the US markets on Friday were: Auto & Truck Manufacturers, up 6.16%; Semiconductors, up 2.64%; Retail – Computers & Electronics, up 2.05%; Software, up 1.38%; and Broadcasting, up 1.35%.

Today’s Market Statistics

At the NYSE, the issues that gained (Advancers) outnumbered the issues that declined (Decliners). There were roughly four Advancers for every three Decliners, or an exact ratio of 1.33-to-1.0. In actual numbers, there were 2,297 Advancers to 1,726 Decliners with 271 Unchanged. The bullish market run continues.

Today, there were 54 new 52-Week Highs and 27 new 52-Week Lows. There were 50 new 52-Week Highs and 30 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 4,280,759,657, or 10% less compared to the total volume of 4,765,888,498 shares traded yesterday.

On the NASDAQ, the Advancers outnumbered the Decliners. There were roughly six Advancers for every five Decliners, or an exact ratio of 1.20-to-1.0. In actual numbers, there were 2,412 Advancers to 2,009 Decliners with 244 Unchanged.

Today, there were 74 new 52-Week Highs and 61 new 52-Week Lows. There were 60 new 52-Week Highs and 61 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 7,580,843,120, or 4% less compared to the total volume of 7,878,477,920 shares traded yesterday.

Oil Price: US crude oil price was at $63.22 a barrel, up 0.32%, as of the time (12:30am EDT, Monday) of this post update.

10 –year Treasury Yield: US Treasury 10-year Treasury yield was down slightly at 4.3% in late afternoon today. The 10-year yield was at 4.243%, as of the time (12:30am EDT, Monday) of this post update.

After-hours action: Stock Futures were down Sunday evening/Monday morning. The Dow Futures was at -0.42% vs. fair value. S&P 500 futures was down -0.55%, and Nasdaq 100 futures was down -0.64% as of the time (12:30am EDT, Monday) of this post update.

.

Regular Market Day Features

The Canadian Vanguard Beginner’s Watchlist

The Canadian big six banks are showing signs of rebounding from recent tariff-driven declines. CIBC (TSX:CM) and TD Bank (TSX:TD) gained eight of the past ten sessions. The charts for the other four banks indicate consolidation for now. We shall keep an eye on them.

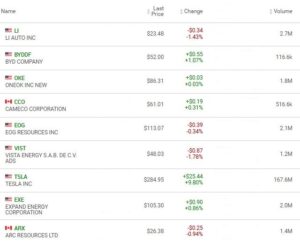

The Blended Growth Stock Watchlist

EV Manufacturers and Resource Stocks

Tesla Inc. (TSLA) stock price appears to currently relate more to Elon Musk’s clout than to the stock’s fundamentals. The recent presentation on Robotaxi lifted the stock price. Also, Tesla stock has loyal followers. BYD Company’s stock (BYDDF) currently has better fundamentals than TSLA stock. However, it is a good idea for an investor who is interested in EV manufacturers’ stocks or the industry to keep a very good eye on both stocks.

NOTICE TO READERS