The Canadian Vanguard Stock Market Report – Tuesday, April 29, 2025

Some Stability Is Returning To The Markets After Months of Tariff Driven Volatilities

.

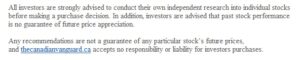

The Toronto Market

The TSX composite index gained 75.89 points or 0.31%, to close the session at 24,874.48. The TSX is back on a two-day winning streak. The markets are also showing signs of some stability.

The Market Breadth: Eight of the ten major sectors gained at the market session. Healthcare, up 1.06%, was the top sector at the market session. Discretionary Consumer Goods and Services gained 0.88%. Technology was up 0.80%; Telecommunications Services gained 0.80%; and Financials gained 0.73%. Durable Consumer Goods and Services was 0.05%; Energy declined -0.40%; and Basic Materials, down -0.62%, was the laggard.

Industry Groups: The top five industry groups in the TSX today were: Media Diversified, up 6.10%; Paper Products, up 2.62%; Coal, up 2.40%; Chemical – Agricultural, 2.32%; and Hotels, Motels & Cruise Lines, up 2.24%.

Today’s Statistics: Today, the issues that gained (Advancers) outnumbered those that declined (Decliners). There were roughly five Advancers for every two Decliners or a more exact ratio of 2.63-to-1.0. In real numbers, there were 1,339 Advancers to 509 Decliners while 147 stocks remained Unchanged.

Today, there were 33 new 52-Week Highs and 2 new 52-Week Lows. There were 30 new 52-Week Highs and 7 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 309,740,213 or about 6% less than the volume of 329,890,196 shares traded yesterday.

Market Roundup:

We cannot be one hundred percent certain that tariff related uncertainties now belong in the past but we recognize that some stability is returning to the market. The TSX index has now gained at nine of the past eleven sessions with none of those giant declines followed by giant gains. Volume was down six percent today but the gain was about the same as yesterday. The decline of Friday was a mere -0.07%. Some stability is certainly returning to the market. Investors should, however, not let their guards down completely as the US president could still come up with more market disrupting tariffs at any time. We should for now take good advantage of the break in the tariff announcements while the break lasts.

.

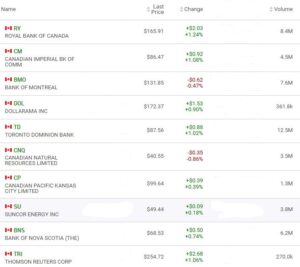

The US Markets

The Dow Jones Average index advanced 300.03 points or 0.75% to close at 40,527.62. The S&P 500 index gained 32.08 points or 0.58% to close at 5,560.83. The Nasdaq Composite was up 95.19 points or 0.55%, to close at 17,461.32.

![]()

The Market Breadth: The market performance keeps getting more positive. Nine of the major sectors gained today. Telecommunications Services, up 1.38%, was the top sector for the second consecutive session. Healthcare was up 0.80%; Financials was up 0.70%; Industrials was up 0.69%; Durable Consumer Goods & Services gained 0.68%; Discretionary Consumer Goods & Services was up 0.60%; Technology was up 0.54%; and Basic Materials was up 0.32%. Energy, down -0.57%, was the laggard.

Industry Groups: The top five industry groups at the US markets on were: Chemicals – Specialty, up 2.11%; Consumer Electronics, was up 1.87%; Commercial Services & Supplies, up 1.85%; Healthcare Facilities, up 1.57%; and Auto & Truck Manufacturers, up 1.57%.

Today’s Market Statistics:

The issues that gained (Advancers) outnumbered the issues that declined (Decliners) at the NYSE. There were two Advancers for every Decliner or an exact ratio of 2.37-to-1.0. In actual numbers, there were 2,902 Advancers to 1,221 Decliners with 252 Unchanged. The rally is very much alive.

Today, there were 75 new 52-Week Highs and 33 new 52-Week Lows. There were 72 new 52-Week Highs and 24 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 4,880,871,000, or 12.7% more than the total volume of 4,327,703,324 shares traded yesterday.

On the NASDAQ, the Advancers outnumbered the Decliners. There were roughly four Advancers for every three Decliners or an exact ratio of 1.60-to-1.0. In actual numbers, there were 2,728 Advancers to 1,703 Decliners with 234 Unchanged.

Today, there were 88 new 52-Week Highs and 62 new 52-Week Lows. There were 89 new 52-Week Highs and 60 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 13,403,003,236, or 23% more than the total volume of 10,868,321,475 shares traded yesterday.

Oil Price: Oil price downtrend continues. US crude oil price was at $59.68 a barrel, down 1.22%, as of the time (11:30pm ET, Tuesday) of this post update.

10 –year Treasury Yield: US Treasury 10-year Treasury yield was down to 4.17% by late afternoon today. The 10-year yield remained at 4.17%, as of the time (11:30pm ET, Tuesday) of this post update.

After-hours action: Stock Futures were down Tuesday evening. The Dow Futures was down -0.21% vs. fair value. S&P 500 futures was down at –0.45%, and Nasdaq 100 futures was down -0.57% as of the time (11:30pm ET, Tuesday) of this post update.

Market Roundup Report:

The current rally remains very much alive. The markets rallied on trade talks’ hopes between the US and some Asian countries, not China of course, will lead to deals being struck. However, we cannot completely ignore the possibility of further tariff announcements in the near term. Current investing or trading strategies must, as such, include strategy to exit positions on short notice. Markets are trending towards more stability and the current rally remains very much alive. S&P 500 has been up six consecutive sessions.

An incentive to get back and active in the market after the tariff volatility is the continued increase in the volume of shares traded in recent sessions. That indicates that institutions are back in the market and are buying – share prices are trending up and indexes are gaining. It is time to get back but may be to start with small purchases – small steps. The chaotic tariff environment of the past weeks are probably not likely to occur as frequently as in the past but it is important to not totally ignore or to at least be mindful of the possibility of new tariffs. It might be a good idea to sell at 10% gain rather than wait for a 20% gain. An additional or an alternative idea is to avoid growth stocks for now but to rather focus on the “safe” sectors: Telecommunications Services and Utilities’ stocks.

.

Stock In The News / Stock To Watch

The US Markets

The earnings season is here and that period often carries the risk of big declines when the earnings disappoints and big gains when the earning impress. Super Micro Computers Inc. (SMCI) was down 19% after the company announced preliminary third quarter preliminary results late Tuesday. Shares of Dell and HP were down by 5% and 2% respectively. The result was not good for server manufacturers.

Visa Inc. (V) stock, edged higher overnight as the company’s earnings report readily beat views. Visa also announced $30 billion stock buyback.

.

Regular Market Day Features

The Canadian Vanguard Beginner’s Watchlist

The Blended Growth Stock Watchlist

We recently updated this watchlist. Gold miner stocks have done well recently but might be taking a break in the short term. The stocks would other wise risk getting extended. We replaced two stocks with Shopify Inc. (SHOP) and Nutrien Ltd (NTR).

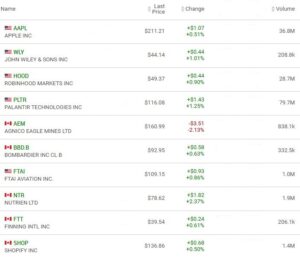

EV Manufacturers and Resource Stocks

NOTICE TO READERS