The Canadian Vanguard Stock Market Report – Monday, April 28, 2025

The Market Indexes marked time today, waiting for a trigger

.

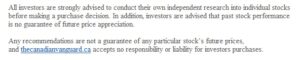

The Toronto Market

The TSX composite index advanced 88.08 points or 0.36%, to close the session at 24,798.59. The TSX composite index took a break on Friday, but is back closing positive at the market today.

The Market Breadth: Eight of the ten major sectors gained at the market session. Technology, up 0.76%, was the top performer. Energy was up 0.58%; Telecommunications Services gained 0.50%; Durable Consumer Goods and Services gained 0.45%; Financials was up 0.34%, and Discretionary Consumer Goods and Services gained 0.11%. The retail sector is springing back to life. Healthcare, down -0.1%, and Industrials, down -0.35%, were the laggards today.

Today’s Statistics: Today, the issues that gained (Advancers) outnumbered those that declined (Decliners). There were roughly two Advancers for every Decliner, or a more exact ratio of 1.80-to-1.0. In real numbers, there were 1,164 Advancers to 655 Decliners while 158 stocks remained Unchanged.

Today, there were 30 new 52-Week Highs and 7 new 52-Week Lows. There were 27 new 52-Week Highs and 4 new 52-Week Lows on Friday.

The total volume of shares traded at the TSX today was 329,890,196, or about the same compared to the volume of 327,168,494 shares traded on Friday.

.

The US Markets

Today was a mixed market session. The Dow Jones Average index was up 114.09 points or 0.28% to close at 40,227.59. The S&P 500 index was barely up, gaining a marginal 3.54 points or 0.06% to close at 5,528.75. The Nasdaq Composite was down -16.81 points or 0.10%, to close at 17,366.13.

The Market Breadth: Eight of the major sectors gained today. Investors were risk-averse today as the top sectors were the “safety” sectors. Telecommunications Services, up 1.38%, was the top-gaining sector. Utilities was up 0.61%; Financials was up 0.56%; Basic Materials was up 0.48%; and Durable Consumer Goods & Services gained 0.20%. Discretionary Consumer Goods & Services, 0.01%, and Technology down, -0.17%, were the laggards.

Today’s Market Statistics:

At the NYSE, the issues that gained (Advancers) outnumbered the issues that declined (Decliners). There were two Advancers for every Decliner, or an exact ratio of 2.00-to-1.0. In actual numbers, there were 2,677 Advancers to 1,341 Decliners with 283 Unchanged. The rally is very much alive.

Today, there were 72 new 52-Week Highs and 24 new 52-Week Lows. There were 54 new 52-Week Highs and 27 new 52-Week Lows on Friday.

The total volume of stocks traded today at the NYSE was 4,327,703,324, or 1% more compared to the total volume of 4,280,759,657 shares traded on Friday.

On the NASDAQ, the Advancers outnumbered the Decliners. There were roughly four Advancers for every three Decliners, or an exact ratio of 1.36-to-1.0. In actual numbers, there were 2,588 Advancers to 1,896 Decliners with 234 Unchanged.

Today, there were 89 new 52-Week Highs and 60 new 52-Week Lows. There were 74 new 52-Week Highs and 61 new 52-Week Lows on Friday.

The total volume of shares traded at the NASDAQ today was 10,868,321,475, or 43% more compared to the total volume of 7,580,843,120 shares traded on Friday.

Oil Price: US crude oil price was at $61.35 a barrel, down 1.11%, as of the time (12:30am EDT, Tuesday) of this post update.

10 –year Treasury Yield: US Treasury 10-year Treasury yield was down five basis points from Friday’s 4.267% by late afternoon today. The 10-year yield was at 4.218%, as of the time (12:30am EDT, Tuesday) of this post update.

After-hours action: Stock Futures were little changed Monday evening. The Dow Futures was at 0.07% vs. fair value. S&P 500 futures was up slightly at 0.05%, and Nasdaq 100 futures was up 0.08% as of the time (12:30am EDT, Tuesday) of this post update.

Market Roundup Report: Today was a mixed market session. Dow Jones index was up, but S&P 500 and Nasdaq were down but marginally from Friday markets’ closing values. We are probably going to have more stability in the markets going forward, but it will be prudent to be always ready for more Trump’s chaotic tariff announcements. The current rally is in excellent shape, and with time and barring any new erratic tariff announcement, the markets are good to go, to be back to normal times. It is time to start getting ready to move back fully into the markets, but proceeding cautiously.

.

Regular Market Day Features

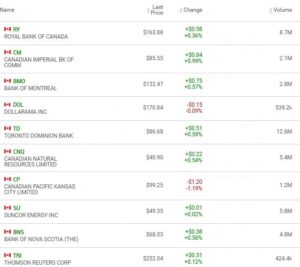

The Canadian Vanguard Beginner’s Watchlist

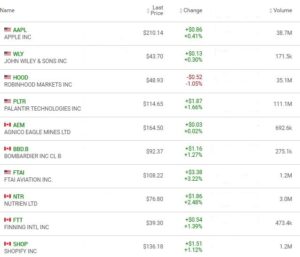

The Blended Growth Stock Watchlist

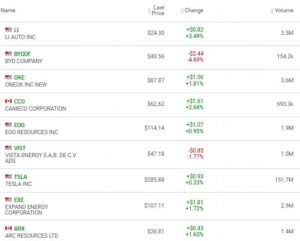

EV Manufacturers and Resource Stocks

NOTICE TO READERS