The Canadian Vanguard Stock Market Report – Monday, May 5, 2025

Palantir Inc. shares fall after hours, Earnings were in line, but did not beat Estimates

.

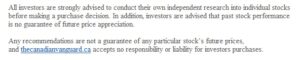

The Toronto Market

The TSX composite index declined -77.99 points or -0.31%, to close the session at 24,953.52. The TSX was down today as some tariff-related announcements were made by the Trump administration. The good news was that the index decline of -0.31% was relatively minor and not a cause for major concern. The volume of shares was also down, further reinforcing the point that the decline today can be ignored.

The Market Breadth

Only four of the ten major sectors gained in the market session. Basic Materials was up 1.27%. Retail sectors: Durable Consumer Goods and Services and Discretionary Consumer Goods and Services were up 0.51% and 0.22% respectively. Telecommunications Services was up 0.10%. Financials was down -0.28%; Technology was down -0.60%, and Industrials was down -0.65%.

Industry Groups: The top five industry groups in the TSX today were: Coal, up 10.15%; Tires & Rubber Products, up 4.05%; Precious Metals & Minerals, up 2.32%; Airlines, up 1.53%; and Restaurants, up 1.28%.

Today’s Statistics: Today, the issues that declined (Decliners) outnumbered those that gained (Advancers). There were roughly four Decliners for every three Advancers, or a more exact ratio of 1.31-to-1.0, much closer than at Friday’s session. In real numbers, there were 1,038 Decliners to 792 Advancers while 147 stocks remained Unchanged.

Today, there were 41 new 52-Week Highs and 8 new 52-Week Lows. There were 43 new 52-Week Highs and 7 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 304,750,972, or about 9%, almost one tenth, less than the volume of 334,020,563 shares traded yesterday.

.

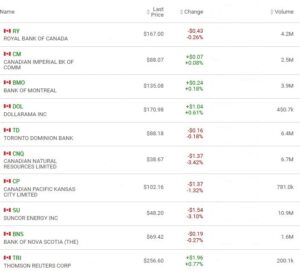

The US Markets

All three US major indexes declined today. The Dow Jones Average index declined -98.60 points or -0.24% to close at 41,218.83. The S&P 500 index was down -36.29 points or -0.64% to close at 5,650.38. The Nasdaq Composite declined -133.49 points or -0.74%, to close at 17,844.24. In small caps, Russell 2000 was down -16.48 points or-0.82% to close at 2004.26. NASDAQ was the laggard index today.

The Market Breadth

The market reversed Friday’s market breadth performance today. Only one of the major sectors gained. Durable Consumer Goods & Services, up a paltry 0.02%, was the only sector to end the session gaining. The market session was negative today. However, except for Energy sector, which was down -1.76%, all the sectors’ declines were under -0.95%. Many sectors declined, but the amplitude of the declines was nowhere near alarming. Financials was down -0.17%; Basic Materials was down -0.22%; Technology was down -0.57%; Discretionary Consumer Goods & Services was down -0.89%; and Industrials was down -0.92%.

Industry Groups: The top five industry groups at the US markets today were: Marine Port Services, up 5.02%; Precious Metals & Minerals, up 2.87%; Airlines, up 1.38%; Financials – Specialty, up 1.22%; and Tobacco, up 1.15%.

Today’s Market Statistics

At the NYSE, the issues that declined (Decliners) outnumbered the issues that gained (Advancers). There were roughly two Decliners for every Advance, or an exact ratio of 1.88-to-1.0. In actual numbers, there were 2,694 Advancers to 1,433 Decliners with 236 Unchanged.

Today, there were 138 new 52-Week Highs and 46 new 52-Week Lows. This is lopsidedly bullish. There were 144 new 52-Week Highs and 47 new 52-Week Lows on Friday.

The total volume of stocks traded today at the NYSE was 4,442,159,582, or 2%, two percent, less than the total volume of 4,917,608,534 shares traded on Friday.

On the NASDAQ, the Decliners outnumbered the Advancers. There were roughly two Decliners for every Advancer, or an exact ratio of 1.88-to-1.0. In actual numbers, there were 2,893 Decliners to 1,539 Advancers with 239 Unchanged.

Today, there were 101 new 52-Week Highs and 68 new 52-Week Lows. There were 110 new 52-Week Highs and 56 new 52-Week Lows on Friday.

The total volume of shares traded at the NASDAQ today was 7,367,580,882, or 13% less than the total volume of 8,481,974,385 shares traded on Friday.

After-hours action: Futures are down slightly this evening. The Dow Futures was down -0.31 vs. fair value. S&P 500 futures was down at -0.48%, and Nasdaq 100 futures was down -0.74% as of the time (11:30pm ET, Monday) of this post update.

Market Roundup Report: Tariffs created some minor market turbulence today. The market indexes were down today, but the current rally remains intact. The next likely market mover comes on Wednesday when the Feds releases the interest rate decision after their meeting. Any Fed’s move on interest rates other than keeping the rates at the current level will surely move the market.

.

Stock in the News /Stock To Watch

Palantir stock’s (PLTR) earnings report, delivered after hours Monday evening, was significantly better than the earnings for the same quarter last year, but the report was in line with estimated earnings and did not beat the estimates. PLTR stock price was down from $123 at market close to $112.70 after earnings report was released. PLTR stock was the top S&P 500 performer last year, and the stock has maintained that performance level for most of this year. A consequence of this performance is that expectations are sky high, and when the earnings report is just in line, some analysts feel disappointed about the stock. Only a perfect score could meet their expectation.

PLTR stock remains a top performer and is a stock we suggest that our readers keep an eye on. A couple of analysts have rated the stock as HOLD at a stock price of $60.00. If you ever see PLTR at such a price within the next few months, you would probably not regret it if you go ahead and buy a “truck load” of it. The price is down after-hours today after the earnings report was released, but we certainly do not see the stock at a $60 price anytime in the foreseeable future. A lot is going for the stock, including high accumulation rating, market reach and most importantly good product that deep-pocketed critical government departments, and more recently commercial, corporations want.

You should not purchase any stock because we feature it positively in any of our reports. You should do your own additional research and buy only if such additional research findings support and drive your purchasing of the stock.

Gold price was up today, and so were several gold miner stocks. Some of the gold miner stocks worth keeping an eye on are: Agnico Eagle Mines (AEM), Franco-Nevada Corp (FNV) , AngloGold Ashanti Plc (AU) and Eldorado Gold (TSX:ELD).

.

Regular Market Day Features

The Canadian Vanguard Beginner’s Watchlist

The Blended Growth Stock Watchlist

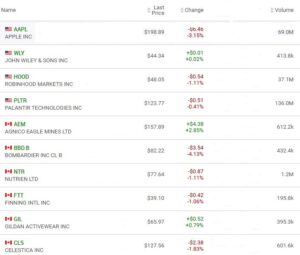

EV Manufacturers and Resource Stocks

NOTICE TO READERS