The Canadian Vanguard Stock Market Report – Thursday, May 1, 2025

Gold Takes a Much-Needed Break As Big Tech Rolls In

.

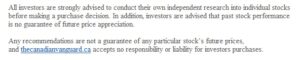

The Toronto Market

The TSX composite index suffered a decline today. The index declined -46.13 points or -0.19%, to close the session at 24,795.55. The TSX has now declined in two consecutive sessions. The declines were relatively small, though, and good for investors. It is certainly preferable that the index does not get extended. A couple of measured declines are good for the index after several sessions of gains.

The Market Breadth

Five of the ten major sectors gained in the market session. Technology, up 0.96%, was the top performer. Financials, up 0.20%, was next. Energy gained 0.17%; Industrials gained 0.10%; and Healthcare gained 0.09%. Discretionary Consumer Goods and Services declined -0.10%; Durable Consumer Goods and Services declined -0.67%; Utilities declined -0.68%; and Telecommunications Services declined -1.67%. Basic Materials, down -1.88%, was the laggard.

Industry Groups: The top five industry groups in the TSX today were: Electronic Components & Equipment, up 4.45%; Beverages – Non Alcoholic, up 4.21%; Chemicals – Commodity, up 2.41%; Retail – Apparel & Accessories, up 2.25%; and Highways & Railtracks, up 2.00%.

Today’s Statistics: Today, the issues that gained (Advancers) outnumbered those that declined (Decliners). There were roughly eight Advancers for every five Decliners, or a more exact ratio of 1.6-to-1.0. In real numbers, there were 1,174 Advancers to 733 Decliners while 129 stocks remained Unchanged.

Today, there were 53 new 52-Week Highs and 7 new 52-Week Lows. There were 42 new 52-Week Highs and 13 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 336,215,160, or 26%, about one quarter less than the volume of 451,630,824 shares traded yesterday.

.

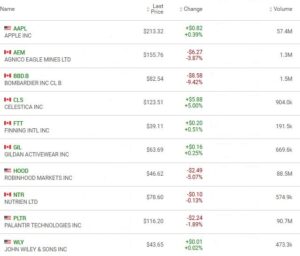

The US Markets

Nasdaq surged today as Meta and Microsoft surged on earnings reports. Meta Platforms (META) & Microsoft Corp (MSFT) recovered some of the ground to tariff volatility. The Dow Jones Average index gained 83.60 points or 0.21% to close at 40,752.96. The S&P 500 index was up 35.08 points or 0.63% to close at 5,604.14. The Nasdaq Composite advanced 264.40 points or 1.52%, to close at 17,710.74. The Dow index has rallied eight consecutive sessions to date.

Volume was down at both the NASDAQ and NYSE, but volume was down a mere 2% only at the NASDAQ.

![]()

The Market Breadth:

Six of the major sectors gained today. Technology, up 1.81%, thanks to Microsoft Inc. and Meta Platforms’ robust earnings report, which dominated the day’s market activity, was the top performer today. Retail was also back, but to a lesser extent. Discretionary Consumer Goods & Services, up 0.64%, was the second-best performer. Energy was up 0.52%; Industrials was up 0.50%; Utilities was up 0.36%; and Financials was up a paltry 0.01%. Telecommunications Services declined -0.70%; Basic Materials declined -0.80%; and Durable Consumer Goods & Services declined -0.84%. Healthcare declined -2.46% and was the laggard today.

Industry Groups: The top five industry groups at the US markets today were: Oil & Gas Drilling, up 6%; Engineering Construction, up 4.84%; Software, up 3.77%; Marine Port Services, up 3.60%; and Retail – Catalog & Internet Order, up 3.00%.

Today’s Market Statistics

At the NYSE, the issues that gained (Advancers) outnumbered the issues that declined (Decliners). There were roughly four Advancers for every three Decliners, or an exact ratio of 1.31-to-1.0. In actual numbers, there were 2,361 Advancers to 1,806 Decliners with 264 Unchanged.

Today, there were 70 new 52-Week Highs and 46 new 52-Week Lows. There were 70 new 52-Week Highs and 50 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 5,012,579,872, or 10% less than the total volume of 5,556,770,893 shares traded yesterday.

On the NASDAQ, the Advancers outnumbered the Decliners. There were roughly six Advancers for every five Decliners, or an exact ratio of 1.19-to-1.0. In actual numbers, there were 2,405 Advancers to 2,019 Decliners with 240 Unchanged.

Today, there were 80 new 52-Week Highs and 71 new 52-Week Lows. There were 75 new 52-Week Highs and 100 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 8,726,027,725, or 2.5%, two and a half percent, less than the total volume of 8,946,283,962 shares traded yesterday.

Market Roundup Report

The market outlook has improved. It is time to start returning to growth stocks. The Big Tech companies today, completely reversed the loss from last month’s tariff chaos. The rally is very much alive and may now be fully supported or even partly driven by Technology going forward.

Oil Price: Oil price reversed the recent downtrend today. US crude oil price was at $59.80 a barrel, up 0.96%, as of the time (10:30pm ET, Thursday) of this post update.

10 –year Treasury Yield: The US Treasury 10-year yield was at 4.231%, as of the time (10:30pm ET, Thursday) of this post update.

After-hours action: Dow Jones Futures reversed and rose as China says it is evaluating US Trade Talks. The Dow Futures rose 0.91 vs. fair value. S&P 500 futures was up at 0.80%, and Nasdaq 100 futures rose 0.50% as of the time (10:30pm ET, Thursday) of this post update.

.

Regular Market Day Features

The Canadian Vanguard Beginner’s Watchlist

The Blended Growth Stock Watchlist

Gold and gold miner stocks are taking a long-expected break. Investors should welcome that “Gold” break for now. Celestica Inc. (CLS) recovered a bit today, but the stock’s chart remains damaged for now. We just need to give the stock more time to do the needed repair.

EV Manufacturers and Resource Stocks

Last month was a bad April for Energy stocks, including non-fossil, new technology energy stocks. We shall be on the lookout to alert our readers if this month brings a different outlook.

NOTICE TO READERS