The Canadian Vanguard Stock Market Report – Thursday, May 22, 2025 Edition

Elevated Treasury Yields Giving Stock Markets Some Jitters, Bounce Collapsed in Session’s final hour

.

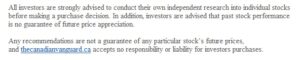

The Toronto Market

The TSX composite index gained a paltry 14.84 points or 0.06%, to close the session at 25,854.01. The TSX is back positive. Yesterday, the index declined after nine sessions of gains. The gain, today, is relatively small, but the index avoided making it two consecutive sessions of declines. The total volume of shares traded was just slightly lower than the volume traded yesterday.

Today’s Statistics: Today, the issues that gained (Advancers) outnumbered those that declined (Decliners). There was roughly one Advancer for every Decliner, or a more exact ratio of 1.02-to-1.0. In real numbers, there were 965 Advancers to 940 Decliners while 166 stocks remained Unchanged.

Today, there were 47 new 52-Week Highs and 34 new 52-Week Lows. There were 73 new 52-Week Highs and 34 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 401,393,405, or 2% less than the volume of 408,918,457 shares traded yesterday.

.

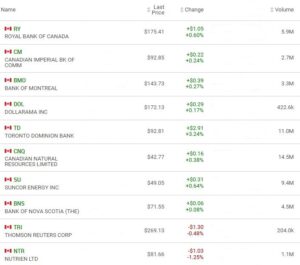

The US Markets

Today’s Market Statistics

Today, at the NYSE, the issues that declined (Decliners) edged out the issues that gained (Advancers). There were roughly six Decliners for every five Advancers, or an exact ratio of 1.17-to-1.0. In actual numbers, there were 2,218 Decliners to 1,898 Advancers with 322 Unchanged.

Today, there were 68 new 52-Week Highs and 99 new 52-Week Lows. There were 188 new 52-Week Highs and 104 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 5,209,320,931, or 2.5% less than the total volume of 5,336,764,734 shares traded yesterday.

On the NASDAQ, the Decliners barely outnumbered the Advancers. There was roughly one Decliner for every Advancer, or an exact ratio of 1.04-to-1.0. In actual numbers, there were 2,275 Decliners to 2,177 Advancers with 262 Unchanged.

Today, there were 84 new 52-Week Highs and 126 new 52-Week Lows. There were 132 new 52-Week Highs and 120 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 8,564,798,952, or 25% less than the total volume of 11,444,578,320 shares traded yesterday.

Market Roundup Report

The market recovered from yesterday’s sell-off but the indexes closed mixed as investor sentiments continued to be driven by the elevated treasury yields. The index declined four basis points after the House passed President Trump’s tax bill today. There was some recovery attempt earlier in the session today, but the bounce faded by the late afternoon. However, the current rally remains intact as the indexes finished either flat or with a slight gain. Growth stocks, however, continue to do well. The current rally remains in good shape.

Oil Price: US crude oil price dipped lower today. US Oil price was back down at $60.84 a barrel as of the time (11:30pm ET, Thursday) of this post update.

10 –year Treasury Yield: The US Treasury 10-year yield was down to 4.53 today after spiking high yesterday. The 10-year yield was at 4.529% as of the time (11:45pm ET, Thursday) of this post update.

After-hours action: Futures were little changed Thursday evening. Dow Futures was up 22.00 points or 0.05% vs. fair value. S&P 500 futures was up 0.01%, and Nasdaq 100 futures was down -0.06% as of the time (9:30 pm ET, Thursday) of this post update.

.

Regular Market Day Features

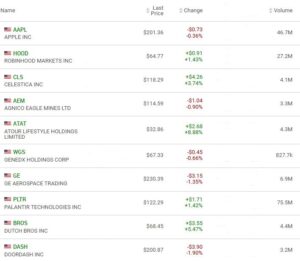

The Blended Growth Stock Watchlist

TD Bank, after presenting a good second quarter earnings report, gained 3.24% or $2.91 to close at $92.81 with 11.0M shares changing hands. The average volume of shares traded daily is 8.4M.

The Blended Growth Stock Watchlist

EV Manufacturers and Resource Stocks

Tesla was up 1.92% as the stock continues to defy weak fundamentals, poor sales and others. The bill passed by the US House of Representatives today would eliminate some of the rebates that Tesla sales depend on.

NOTICE TO READERS