The Canadian Vanguard Stock Market Report – Tuesday, May 6, 2025

US – China Trade Talks set to commence later this week

.

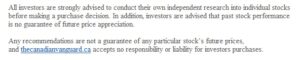

The Toronto Market

The TSX composite index was up 21.20 points or 0.09%, to close the session at 24,974.72. The total volume of shares traded today was about the same as in the market session yesterday.

Gold hit a record high again earlier today but was down slightly by -0.47% in the afterhours market as of the time of this post.

Today’s Market Statistics

Today, the issues that declined (Decliners) outnumbered those that gained (Advancers). There were roughly one Decliner for every Advancer, or a more exact ratio of 1.13-to-1.0. In real numbers, there were 972 Decliners to 862 Advancers while 150 stocks remained Unchanged.

Today, there were 41 new 52-Week Highs and 10 new 52-Week Lows. There were 41 new 52-Week Highs and 10 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 304,302,579, or about the same as the volume of 304,750,972 shares traded yesterday.

.

The US Markets

All three major indexes declined today, for the second consecutive market session. The Dow Jones Average index retracted -389.33 points or -0.95% to close at 40,829.00. The S&P 500 index was down -43.47 points or -0.77% to close at 5,606.91. The Nasdaq Composite declined -154.58 points or -0.87%, to close at 17,689.66. In small caps, Russell 2000 was down -21.07 points or-1.05% to close at 1983.19.

Today’s Market Statistics

Today at the NYSE, the issues that declined (Decliners) outnumbered the issues that gained (Advancers). There were roughly four Decliners for every three Advancers, or an exact ratio of 1.34-to-1.0. In actual numbers, there were 2,381 Decliners to 1,769 Advancers with 254 Unchanged.

Today, there were 95 new 52-Week Highs and 59 new 52-Week Lows. There were 138 new 52-Week Highs and 46 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 4,827,936,426, or 8.7%, almost one-tenth, more than the total volume of 4,442,159,582 shares traded yesterday.

On the NASDAQ, the Decliners totally outnumbered the Advancers. There were roughly two Decliners for every Advancer, or an exact ratio of 1.80-to-1.0. In actual numbers, there were 2,848 Decliners to 1,582 Advancers with 239 Unchanged.

Today, there were 55 new 52-Week Highs and 110 new 52-Week Lows. There were 101 new 52-Week Highs and 68 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 7,303,804,849, or about the same as the total volume of 7,367,580,882 shares traded yesterday.

Market Roundup Report

Gold hit record highs again earlier today as all three major indexes were down. The current rally also appears to be suffering from the effects of Trump’s tariffs. The next likely market mover comes up tomorrow during the usual post-Fed’s meeting briefing by the Fed’s chairman. Any Fed’s move on interest rates other than keeping the rates at the current level will surely move the market. The odds, as per market analysts, however, are not in favour of any rate cut at the current Fed meeting.

Oil Price: U.S. crude oil futures rose. Oil price was up slightly more than 3% earlier today as China and Europe are seeing signs of higher demand. US Oil price was up at $59.60 a barrel as of the time (11:30pm ET, Tuesday) of this post update.

10 –year Treasury Yield: US Treasury 10-year yield fell after a $42 billion auction of new 10-year notes attracted strong demand. A few weeks ago, a similar auction got a lukewarm reception as foreign investors shunned US government bonds in the display of their displeasure with Trump’s administration’s arbitrary tariff levies.

The 10-year yield was at 4.305% this afternoon but was at 4.312%, as of the time (11:30pm ET, Tuesday) of this post update.

After-hours action: Futures were up following the news that the US-China trade talks will start later this week. The Dow Futures was up 0.63% vs. fair value. S&P 500 futures was up at 0.68%, and Nasdaq 100 futures was up 0.75% as of the time (11:30pm ET, Tuesday) of this post update.

.

Regular Market Day Features

The Canadian Vanguard Beginner’s Watchlist

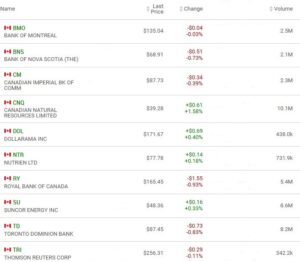

The Blended Growth Stock Watchlist

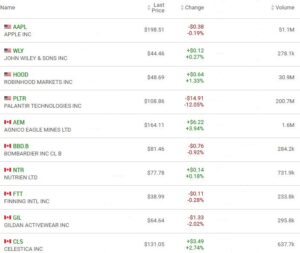

EV Manufacturers and Resource Stocks

NOTICE TO READERS