The Canadian Vanguard Stock Market Report – Wednesday, April 16, 2025

.

The Bearish Rampage Continues

.

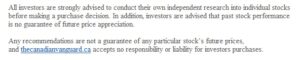

The Toronto Market

The TSX composite index was up 38.86 points or 0.16%, to close the session at 24,106.79. The TSX index had a tension-laden market session. The index closed well off the session low and well below the session high despite late afternoon attempted recovery. The TSX index has, however, to date recorded three consecutive gaining sessions, even though the gain today was only 19% of TSX index’s gain yesterday.

The Market Breadth: Six of the major sectors ended the session gaining compared with eight at yesterday’s market and nine sectors on Monday. Basic Materials, up 1.30%, was the top gainer among the sectors. Energy gained 1.11%; Durable Consumer Goods and Services was up 0.85%; telecommunications services gained 0.44%; Utilities gained 0.36%; and Technology gained 0.18% to round up the list of gainers. Financials, down -0.18%, Discretionary Consumer Goods & Services, down -0.34% and Industrials, down -1.08%, were the laggard sectors.

Industry Groups: The top five industry groups in the TSX today were: Computer hardware, up 9.05%, Tires & Rubber Products, up 4.47%; Oil & Gas Exploration & Production, up 2.38%; Textile & Leather Goods, up 2.27%; and Medical Equipment, Supplies & Distribution, up 1.99%.

Today’s Statistics: The issues that declined (Decliners) outnumbered those that gained (Advancers). There were roughly three Decliners for every two Advancers, or a more exact ratio of 1.46-to-1.0. In real numbers, there were 1,137 Decliners to 777 Advancers while 127 stocks remained Unchanged.

Today, there were 48 new 52-Week Highs and 15 new 52-Week Lows. There were 27 new 52-Week Highs and 66 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 371,785,141, or roughly the same compared to the volume of 368,840,341 shares traded yesterday.

.

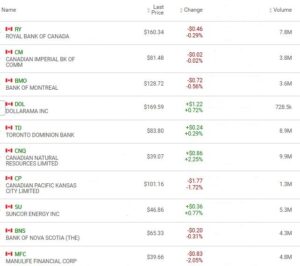

The US Markets

All three major US indexes declined heavily today. The Dow Jones Average index declined -699.83 points or -1.73% to close at 39,669.39. The S&P 500 index was down -120.93 points or -2.24% to close at 5,275.70. The Nasdaq Composite cratered a hefty -516.01 points or -3.07%, to close at 16,307.17.

![]()

The Market Breadth: Only one of the eleven major sectors gained in the market session, and Energy, up 1.03%, was that sector. All the other sectors got clobbered. Today was a really negative market session. Basic Materials declined -0.24%; Utilities declined -0.70%; Durable Consumer Goods & Services was down -1.03%; Financials was down -1.07%; Telecommunications Services was down -1.48%; Discretionary Consumer Goods & Services declined -2.32%; and Technology, down -3.23%, was the laggard.

Industry Groups: The top five industry groups at the US markets today were: Rails & Roads – Passengers, up a hefty 18.71%; Precious Metals & Minerals, up 2.55%; Marine Port Services, up 2.51%; Airport Services, up 1.86%; and Oil & Gas Exploration & Production, up 1.75%. Some of the member companies of the “Rails & Roads – Passengers” industry group, tickers only, are: CAR, DIDIY, PAL and W.

Today’s Market Statistics:

At the NYSE, the issues that declined (Decliners) outnumbered the issues that gained (Advancers). There were roughly three Decliners for every two Advancers or an exact ratio of 1.58-to-1.0. In actual numbers, there were 2,536 Decliners to 1,606 Advancers with 267 Unchanged.

Today, there were 80 new 52-Week Highs and 105 new 52-Week Lows. Yesterday, there were 49 new 52-Week Highs and 67 new 52-Week Lows.

The total volume of stocks traded today at the NYSE was 4,712,173,679. This was 7% more compared to the total volume of 4,414,823,635 shares traded yesterday

On the NASDAQ, the Decliners outnumbered the Advancers. There were roughly two Decliners for every Advancer, or an exact ratio of 2.01-to-1.0. In actual numbers, there were 2,964 Decliners to 1,469 Advancers with 211 Unchanged. .

Today, there were 45 new 52-Week Highs and 182 new 52-Week Lows. There were 42 new 52-Week Highs and 103 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 8,208,534,118. This is 3.5% more compared to the total volume of 7,930,176,234 shares traded yesterday.

Oil Price: U.S. crude oil price was up roughly 1% to down to $62.50 a barrel earlier today. US crude oil price was at $63.32 a barrel, up 1.30%, as of the time (12:30am EDT, Thursday) of this post update.

After-hours action: Futures were up Wednesday evening and going late into early morning Thursday. The Dow Futures was up 0.80% vs. fair value. S&P 500 futures was up 0.91%, and Nasdaq 100 futures was up 0.99% as of the time (12:30am EDT, Thursday) of this post update.

Market Roundup Report: The institutions are clearly selling off, so retail investors should only be minimally invested at this time, given the current market environment and should be ready to spin in and out as necessary. The US market is currently in a high-risk posture.

.

Stock In The News / Stock To Watch

The Toronto Market

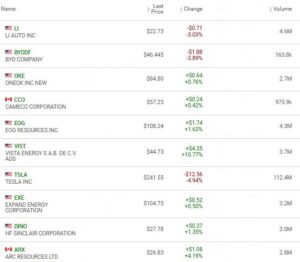

The TSX index appears to be trying to stabilize, compared to the US markets’ indexes. Gold miner stocks continue to do well. Stocks like Agnico Eagle Mines (TSX:AEM) and Franco-Nevada Corp (TSX:FNV) are worth keeping an eye on if not already in your watchlist. AEM may be approaching being extended. Energy stocks are also starting to do well. A good idea is to, for now, avoid bringing new money into the market to purchase technology stocks. Some patience is required for now when it comes to technology stocks. It is also a good idea to consider staying in cash, if you are not already in the market, until the markets stabilize or the Trump administration’s tariff regime becomes clearer or more conventional in style or approach.

The US Markets

The markets were rocked again today by the news that NVIDIA reported that it will take a quarterly charge of about $5.5 billion tied to exporting H20 graphics processing units to China and other destinations. The new tariffs being demanded by Trump’s administration are the root cause of the $5.5 billion charge. Nvidia Corp’s (NVDA) stock was down -6.87% or -$7.71 to close at $104.49 with 397M shares changing hands. The Trump administration has signalled for months that they were considering a crackdown on exports of processors from US companies that have helped major Chinese advances in artificial intelligence. Share price of Advanced Micro Devices (AMD) was down similarly. AMD stock closed today at $88.29, down -7.35% or -$7.00, with 62.1M shares traded today. One way to avoid the related volatility is to avoid NVDA stock in the short term. The NVDA news rocked the markets hard today. Staying in Cash is a realistic option at this time, given the current market volatility.

.

Regular Market Day Features

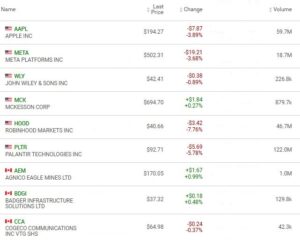

The Canadian Vanguard Beginner’s Watchlist

Dollarama, Dollar Tree and the low-cost retail outlets’ stocks are worth keeping an eye on as tariff-related US government directives continue to traumatize the markets.

The Blended Growth Stock Watchlist

The markets have rotated away from the so-called Magnificent Seven. It may be time to start thinking of doing the same as part of the initiative to protect what is left of your portfolio your portfolio after weeks of tariff turmoil.

EV Manufacturers and Resource Stocks

Electric Vehicle (EV) manufacturers’ stock are currently not the most robust investment vehicle at this time. However, the new Energy and Resource stocks are making up for the problems with EV manufacturers’ stocks and are worth keeping an eye.

NOTICE TO READERS