The Canadian Vanguard Stock Market Report – Wednesday, April 23, 2025

Markets Are Slowly Coming Back To life, Thanks To Trump’s Backing Down on Business-Damaging Tariffs on China

.

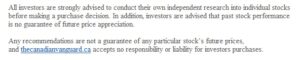

The Toronto Market

The TSX composite index gained 166.70 points or 0.69%, to close the session at 24,472.68. The TSX composite index is back in an upswing. The index has now been up in six of the past seven sessions.

Today’s Statistics: The issues that gained (Advancers) outnumbered those that declined (Decliners). There were three Advancers for every Decliner, or a more exact ratio of 3.07-to-1.0. In real numbers, there were 1,483 Advancers to 482 Decliners while 103 stocks remained Unchanged.

Today, there were 38 new 52-Week Highs and 5 new 52-Week Lows. There were 50 new 52-Week Highs and 21 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 399,012,994, or 5% more compared to 380,357,304 shares traded yesterday.

.

The US Markets

The Dow Jones Industrial Average index gained 419.59 points or 1.07% to close at 39,606.57. The S&P 500 index was up 88.10 points or 1.67% to close at 5,375.86. The Nasdaq Composite advanced 407.63 points or 2.50%, to close at 16,708.05. The markets today, tried and successfully consolidated the gains from yesterday’s session.

Today’s Market Statistics: At the NYSE, the issues that gained (Advancers) outnumbered the issues that declined (Decliners). There were roughly three Advancers for every Decliner, or an exact ratio of 3.28-to-1.0. In actual numbers, there were 3,193 Advancers to 972 Decliners with 235 Unchanged. The market is on a two-day, back-to-back, run of session of market gains.

Today, there were 43 new 52-Week Highs and 28 new 52-Week Lows. There were 50 new 52-Week Highs and 44 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 5,428,521,679, or 14% more compared to the total volume of 4,752,679,988 shares traded yesterday.

On the NASDAQ, the Advancers outnumbered the Decliners. There were roughly three Advancers for every Decliner, or an exact ratio of 2.84-to-1.0. In actual numbers, there were 3,301 Advancers to 1,160 Decliners with 222 Unchanged.

Today, there were 73 new 52-Week Highs and 44 new 52-Week Lows. There were 55 new 52-Week Highs and 84 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 8,943,594,634, or 22% more compared to the total volume of 7,311,776,597 shares traded yesterday.

Oil Price: US crude oil price was at $62.33 a barrel, up 0.10%, as of the time (12:30am EDT, Thursday) of this post update.

10 –year Treasury Yield: US Treasury 10-year Treasury yield was down at 4.36% in late afternoon today. The 10-year yield was at 4.356%, as of the time (12:30am EDT, Thursday) of this post update.

After-hours action: Futures were down slightly Wednesday evening. The Dow Futures was down -0.32% vs. fair value. S&P 500 futures was down -0.23%, and Nasdaq 100 futures was down -0.33% as of the time (12:30am EDT, Thursday) of this post update.

Market Roundup Report:

The indexes closed with gains but closed off lows. However, the highs earlier today were high. Dow was, for example, as high as 1,100 points earlier today. While such a figure fitted in yesterday, we think it is better that Dow closed at a more normal gain of 400 points today. The gains should be coming in small doses rather than in gargantuan amounts, but not easily supported figures, especially for blue chips in the Dow index.

The market is still very much tariff news driven, but we are more likely to receive Trump’s erratic tariff policy “gifts” in small doses. The other good news today is that the market gains were accompanied by a good volume percentage increase in the volume of shares traded. The institutions are returning to the market. Russell 2000 was up 1.53%, so the small caps made gains in the market today. Volume is returning to the market.

.

Regular Market Day Features

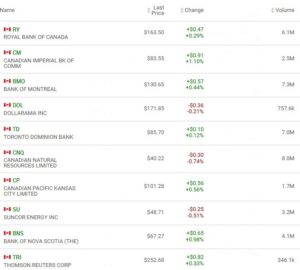

The Canadian Vanguard Beginner’s Watchlist

The Blended Growth Stock Watchlist

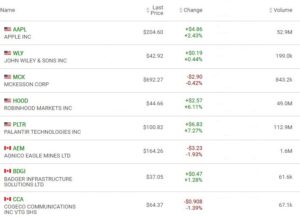

EV Manufacturers and Resource Stocks

NOTICE TO READERS