The Canadian Vanguard Stock Market Report – Wednesday, April 30, 2025

The current rally displayed Stamina with Strong Resilience Today

.

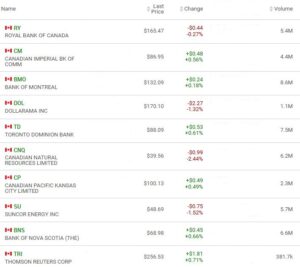

The Toronto Market

The TSX composite index declined -32.80 points or -0.13%, to close the session at 24,841.68. The market showed strength and resilience today. Bad economic news brought the index down about 350 points within thirty minutes of today’s opening bell but the market and the TSX composite index recovered ninety percent off that low to close the market session, down a mere 0.13%. That shows resilience by the current rally and sends the message that the current rally has stamina.

The Market Breadth: Eight of the ten major sectors gained at the market session. Durable Consumer Goods and Services was up 2.29%; Utilities gained 1.26%; Telecommunication Services gained 1.20%; Healthcare, was up 0.41%; Financials gained 0.35%; and Discretionary Consumer Goods and Services eked out a 0.05% gain. Energy, down -1.42%, and Technology, down -2.19%, were the laggards at the market close.

Industry Groups: The top five industry groups in the TSX today were: Aluminum, up 20.83%; Apparel & Accessories, up 5.95%; Tires & Rubber Products, up 4.28%; Casinos & Gaming, up 3.68%; and Pharmaceuticals – Generic & Specialty, up 3.57%.

Today’s Statistics: Today, the issues that declined (Decliners) outnumbered those that gained (Advancers). There were roughly four Decliners for every three Advancers or a more exact ratio of 1.31-to-1.0. In real numbers, there were 1,094 Decliners to 832 Advancers while 122 stocks remained Unchanged.

Today, there were 42 new 52-Week Highs and 13 new 52-Week Lows. There were 33 new 52-Week Highs and 2 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 451,630,824, or about 43% more than the volume of 314,947,310 shares traded yesterday.

.

The US Markets

The Dow Jones Average index gained 141.74 points or 0.35% to close at 40,669.26. The S&P 500 index was up 8.23 points or 0.15% to close at 5,569.06. The Nasdaq Composite was down -14.98 points or -0.09%, to close at 17,446.34. In small caps, Russell 2000 closed the session down -12.40 or -0.63% to close at 1964.12. Dow Jones index was the top performer of the three major indexes. The Dow index has rallied seven consecutive sessions to date.

![]()

The Market Breadth: Only five of the major sectors gained today. Telecommunications Services, up 1.69%, was the top sector for the third consecutive session. Investors are currently it playing safe. Healthcare was up 0.86%; Durable Consumer Goods & Services gained 0.79%; Industrials was up 0.41%; and Technology was up 0.20%. Basic Materials declined -0.16%; Financials was down -0.26%; and Discretionary Consumer Goods & Services declined -0.84%. Energy, down -2.37%, was the laggard today.

Industry Groups: The top five industry groups at the US markets were: Diversified Trading & Distributing, up 10.96%; Construction Materials, up 2.99%; Airport Services, up 1.90%; Biotechnology, up 1.85%; and Integrated Telecommunications Services, up 1.76%.

Today’s Market Statistics:

Today, at the NYSE, the issues that declined (Decliners) outnumbered the issues that gained (Advancers). There were six Decliners for every five Advancers, or an exact ratio of 1.20-to-1.0. In actual numbers, there were 2,244 Decliners to 1,889 Advancers with 278 Unchanged.

Today, there were 70 new 52-Week Highs and 50 new 52-Week Lows. There were 75 new 52-Week Highs and 33 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 5,556,770,893, or 14% more than the total volume of 4,880,871,000 shares traded yesterday.

On the NASDAQ, the Decliners outnumbered the Advancers. There were six Decliners for every five Advancers, or an exact ratio of 1.22-to-1.0. In actual numbers, there were 2,441 Decliners to 1,991 Advancers with 236 Unchanged.

Today, there were 75 new 52-Week Highs and 100 new 52-Week Lows. There were 88 new 52-Week Highs and 62 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 8,946,283,962, or 33%, or one third, less than the total volume of 13,403,003,236 shares traded yesterday.

10 –year Treasury Yield: US Treasury 10-year Treasury yield was down to 4.17% by late afternoon today. The 10-year yield was at 4.183%, as of the time (1:30am ET, Thursday) of this post update.

After-hours action: Stock Futures are up Thursday morning. The Dow Futures rose 0.58% vs. fair value. S&P 500 futures was up at 1.06%, and Nasdaq 100 futures rose 1.44% as of the time (1:30am ET, Thursday) of this post update.

Market Roundup Report: The current rally remains very much alive. The current showed resilience today. Telecommunications Services sector has been outperforming recently as investors play risk-averse. The markets are showing stability and less volatility, but it is prudent to keep in mind that new tariffs could be announced at any time. It is smart to “trade safe”.

Stock In The News / Stock To Watch

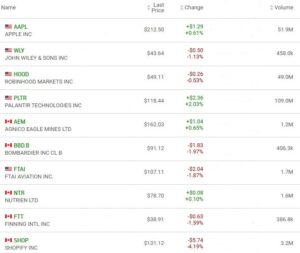

The US Markets

Microsoft Corp (MSFT) and Meta Platforms (META) reported robust earnings late Wednesday. The stocks were each up nine percent after hours Wednesday evening. It is important to remember that the overnight performance is not a good predictor of a stock’s performance in the following regular session. It is, however, good practice to keep an eye on big movers resulting from the earnings report. Earnings reports typically cause big price moves, up or down, depending on how the market perceives the report.

Microsoft is a big player in the technology sector, as such, other stocks may rise or fall in sympathy with the MSFT stock’s move after the earnings report. Broadcom Inc. (AVGO), a technology stock, looks likely to move in sympathy with MSFT and META stocks. The market will, of course, always do whatever it wishes to do.

.

Regular Market Day Features

The Canadian Vanguard Beginner’s Watchlist

The Blended Growth Stock Watchlist

Stocks to keep an eye on, at Thursday’s market, within this watchlist include Agnico Eagle Mines (AEM) and Franco Nevada (FNV). Gold price rose steadily while the tariff chaos persisted, but it is currently moderating. Another stock to keep an eye on within the list is Robin Hood Markets (HOOD), which is a stock that is not for the risk-averse investor.

EV Manufacturers and Resource Stocks

NOTICE TO READERS