The Canadian Vanguard Stock Market Report – Weekend May 2 – 4, 2025 Edition

The Bulls Were in Complete Control at Friday’s Market Session

.

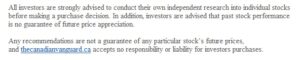

The Toronto Market (Friday, May 2)

The TSX composite index rebounded with vigour today. The index advanced 235.96 points or 0.95%, to close the session at 25,031.51. The TSX had a robust performance on Friday, and the volume was about the same as the total volume on Thursday. The current rally got a big boost today.

The Market Breadth

Eight of the ten major sectors gained in the market session. Industrials, up 1.72%, was the top performer. Technology was up 1.49%; Energy was up 1.12% and Financials was up 1.06%. Healthcare gained 0.74%; Discretionary Consumer Goods and Services was up 0.63%; and Durable Consumer Goods and Services gained 0.63%. Utilities, down -0.57%; and Telecommunications Services, down -0.78%, were the bottom performers today. The market outlook remains upbeat and given that the two laggard sectors today, the market appears to be leaning towards growth while also being less risk-averse.

The Sectors This Week: Healthcare sector, up 4.01%, was the top gainer for this week, repeating last week’s performance. Durable Consumer Goods & Services was up 2.46%; Financials gained 1.95%; Utilities was up 1.47%; Technology was up 1.39%; and Discretionary Consumer Goods & Services was up 1.03%. There is something reassuring about seeing Financials ranking among the top performers. If the Banks and lenders are not doing well, the economy is probably not doing well either. The market will, of course, always do what it wishes to do.

Industry Groups: The top five industry groups in the TSX today were: Retail – Apparel & Accessories, up 13.25%; Advertising / Marketing, up 5.98%; Electrical Components & Equipment, up 4.75%; Media Diversified, up 4.29%; and Rails & Roads – Freights, up 4.11%. Three members of the Retail – Apparel group are: Aritzia Inc. (TSX: ATZ), Reitmans Canada (TSX: RET.A) and Roots Corp (TSX: ROOT).

Today’s Statistics

Today, the issues that gained (Advancers) outnumbered those that declined (Decliners). There were roughly five Advancers for every two Decliners, or a more exact ratio of 2.33-to-1.0. In real numbers, there were 1,306 Advancers to 560 Decliners while 130 stocks remained Unchanged.

Today, there were 43 new 52-Week Highs and 7 new 52-Week Lows. There were 53 new 52-Week Highs and 7 new 52-Week Lows yesterday.

The total volume of shares traded at the TSX today was 334,020,563, or about the same as the volume of 336,215,160 shares traded yesterday.

.

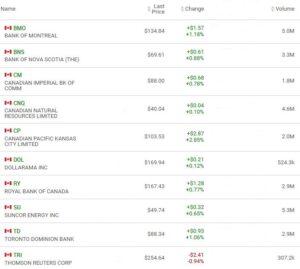

The US Markets (Friday, May 2)

Nasdaq maintained the momentum from yesterday’s session today. All three indexes gained today. The Dow Jones Average index advanced 564.47 points or 1.39% to close at 41,317.43. The S&P 500 index gained 82.53 points or 1.47% to close at 5,686.67. The Nasdaq Composite advanced 266.99 points or 1.51%, to close at 17,977.73. In small caps, Russell 2000 was up 44.88 or 2.27% to close at 2020.74. NASDAQ was the top performer of the three indexes, repeating Thursday’s performance.

The Market Breadth

Today was certainly an upbeat mood session. All the sectors gained, but Financials, up 2.05%, was the top gainer. It is rare to have Financials lead the sectors. Technology, up 1.88%, was next. Industrials gained 1.82%; Energy gained 1.53%; and Basic Materials gained 1.43%. Retail sectors were not far behind: Discretionary Consumer Goods & Services was up 1.37%, and Durable Consumer Goods & Services was up 0.76%. Utilities was up 0.88%; and Telecommunications Services, up 0.47%, was bringing up the rear.

For The Week: Technology, up 4.11%, was the top gainer; Industrials was up 1.92%; Discretionary Consumer Goods & Services gained 1.88%; and Utilities was up 1.12%. Financials was up 0.90% for the week. Telecommunications Services, down -0.14%; Basic Materials, down -0.94%; and Energy, down -1.69% were the laggards this week. Retail sector stocks are likely to carry over their performance during the month of April well into May.

Industry Groups: The top five industry groups at the US markets today were: Airlines, up 5.06%; Rails & Roads Freights, up 5.01%; Textile & Leather Goods, up 4.13%; Office Equipment, up 3.93%; and Appliances, Tools & Housewares, up 3.90%.

Today’s Market Statistics

At the NYSE, the issues that gained (Advancers) outnumbered the issues that declined (Decliners). There were roughly four Advancers for every Decliner, or an exact ratio of 3.82-to-1.0. In actual numbers, there were 3,282 Advancers to 858 Decliners with 249 Unchanged.

Today, there were 144 new 52-Week Highs and 47 new 52-Week Lows. This is lopsidedly bullish. There were 70 new 52-Week Highs and 46 new 52-Week Lows yesterday.

The total volume of stocks traded today at the NYSE was 4,917,608,534, or 2%, two percent, less than the total volume of 5,012,579,872 shares traded yesterday.

On the NASDAQ, the Advancers outnumbered the Decliners. There were roughly three Advancers for every Decliner, or an exact ratio of 2.76-to-1.0. In actual numbers, there were 3,268 Advancers to 1,185 Decliners with 232 Unchanged.

Today, there were 110 new 52-Week Highs and 56 new 52-Week Lows. There were 80 new 52-Week Highs and 71 new 52-Week Lows yesterday.

The total volume of shares traded at the NASDAQ today was 8,481,974,385, or 3% less than the total volume of 8,726,027,725 shares traded yesterday.

Oil Price: U.S. crude oil futures dived after the OPEC group agreed to raise production in June. US Oil price was down at $56.05 a barrel as of the time (9:30pm ET, Sunday) of this post update.

10 –year Treasury Yield: The US Treasury 10-year Treasury yield was at 4.308%, down -0.01%, as of the time (9:30pm ET, Sunday) of this post update.

After-hours action: Dow Jones Futures was down Sunday evening. The Dow Futures declined -0.72% vs. fair value. S&P 500 futures was down at -0.80%, and Nasdaq 100 futures was down -0.91% as of the time (9:30pm ET, Sunday) of this post update.

Market Roundup Report

The market outlook has improved. The market outlook is currently “upbeat”. It is time to start returning to growth stocks. However, it will be premature to think that the era of tariff increases is over. It is, as such, advisable to not be over exposed in the market yet. The market breadth on Friday was broad-based. All the major sectors advanced. Technology stocks were up but so were retail stocks and small caps. It is smart to avoid extended stocks and to also take necessary precautions at market session around earnings report delivery for stock in one’s portfolio.

Some of stocks due to report earnings this week are: On Monday, Palantir Technologies (PLTR), Hims & Hers Health (HIMS); On Tuesday, American Electric Power (AEP), Arista Networks (ANET), Embraer (ERJ), Sunoco (SUN); On Wednesday, DoorDash (DASH), Uber Technologies (UBER), AppLovin (APP), CF Industries Holdings (CF); and on Thursday, McKesson (MCK), Toast (TOST), Shopify Inc. (SHOP), Coinbase Global (COIN), Evergy (EVRG) and Enbridge (ENB).

.

Regular Market Day Features

The Canadian Vanguard Beginner’s Watchlist

The Blended Growth Stock Watchlist

Apple Inc. (AAPL) delivered an upbeat earnings report, but the impact on the stock was short-lived as the market focused more on the effect of tariffs on the company’s operations. AAPL stock price fell as the effect of tariffs is likely to have a big impact on the company’s business operations.

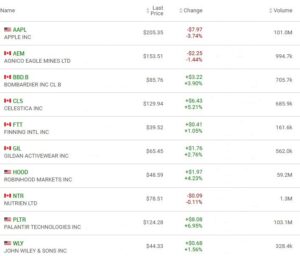

EV Manufacturers and Resource Stocks

NOTICE TO READERS